Disclosure of assets

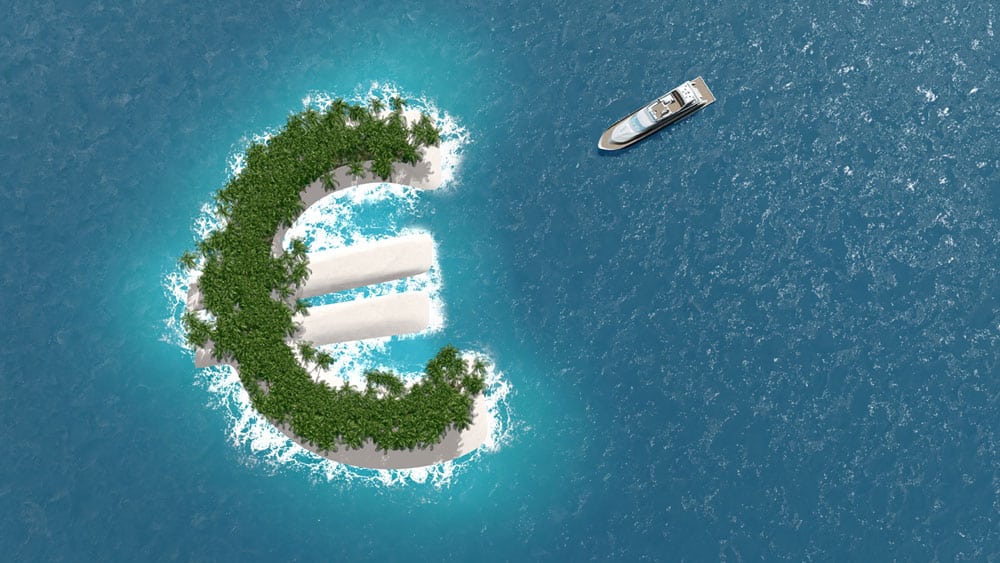

In light of the Panama Papers and their revelations, it would appear that it is not only tax evasion is in the headlines but also tax avoidance schemes. Evading tax by concealing income is illegal, avoiding tax by exploiting the tax rules technically is not.

To help tax authorities in various countries hunt out those individuals and companies trying to hide assets, the UK has recently signed a disclosure of asset agreement with Spain, Germany, France and Italy. What does this mean? It means that the UK, in partnership with France, Germany, Spain and Italy, have passed regulations that will lead to the automatic sharing of information about the true owners of companies, complex shell companies and overseas trusts.

To help tax authorities in various countries hunt out those individuals and companies trying to hide assets, the UK has recently signed a disclosure of asset agreement with Spain, Germany, France and Italy. What does this mean? It means that the UK, in partnership with France, Germany, Spain and Italy, have passed regulations that will lead to the automatic sharing of information about the true owners of companies, complex shell companies and overseas trusts.

There are around 4.5 million British people living the expatriate life, and with 1.3 million of these currently residing in the EU, it is easy to understand why there is mounting political pressure for the government to give them full voting rights in the upcoming referendum on the future of British involvement in Europe. After all, they have so much at stake, from their residency and tax status to the future of their

There are around 4.5 million British people living the expatriate life, and with 1.3 million of these currently residing in the EU, it is easy to understand why there is mounting political pressure for the government to give them full voting rights in the upcoming referendum on the future of British involvement in Europe. After all, they have so much at stake, from their residency and tax status to the future of their  At the moment, politicians across the world – especially, it seems, in the UK – are in the spotlight regarding their tax affairs. Banks, however, will also soon be in the spotlight, as by Friday 15th April they have been told to hand any information regarding their dealings with the law firm at the centre of the Panama Papers over to the UK’s Financial Conduct Authority.

At the moment, politicians across the world – especially, it seems, in the UK – are in the spotlight regarding their tax affairs. Banks, however, will also soon be in the spotlight, as by Friday 15th April they have been told to hand any information regarding their dealings with the law firm at the centre of the Panama Papers over to the UK’s Financial Conduct Authority. It has been revealed that Harvey McGregor, the lawyer who innovated Grand Cayman as a tax planning centre for high net worth individuals, inspiring the growth of the financial services community in the Caribbean islands, has left an estate worth £1.4 million to his long-term partner.

It has been revealed that Harvey McGregor, the lawyer who innovated Grand Cayman as a tax planning centre for high net worth individuals, inspiring the growth of the financial services community in the Caribbean islands, has left an estate worth £1.4 million to his long-term partner. were digesting news of a major leak of confidential and reportedly revealing documents from a Panamanian law firm. Some are calling it the biggest leak of confidential information ever to hit the global financial services industry.

were digesting news of a major leak of confidential and reportedly revealing documents from a Panamanian law firm. Some are calling it the biggest leak of confidential information ever to hit the global financial services industry. Providers of

Providers of  As the baby boomers hit pensionable age, the issue of pensions has become more important politically than ever before. This is a fact which has been reflected in the raft of changes that have been made by both the current and the previous government over the past few years. Baby boomers could be forgiven for feeling a little confused by it all and even retired expats with considerable

As the baby boomers hit pensionable age, the issue of pensions has become more important politically than ever before. This is a fact which has been reflected in the raft of changes that have been made by both the current and the previous government over the past few years. Baby boomers could be forgiven for feeling a little confused by it all and even retired expats with considerable