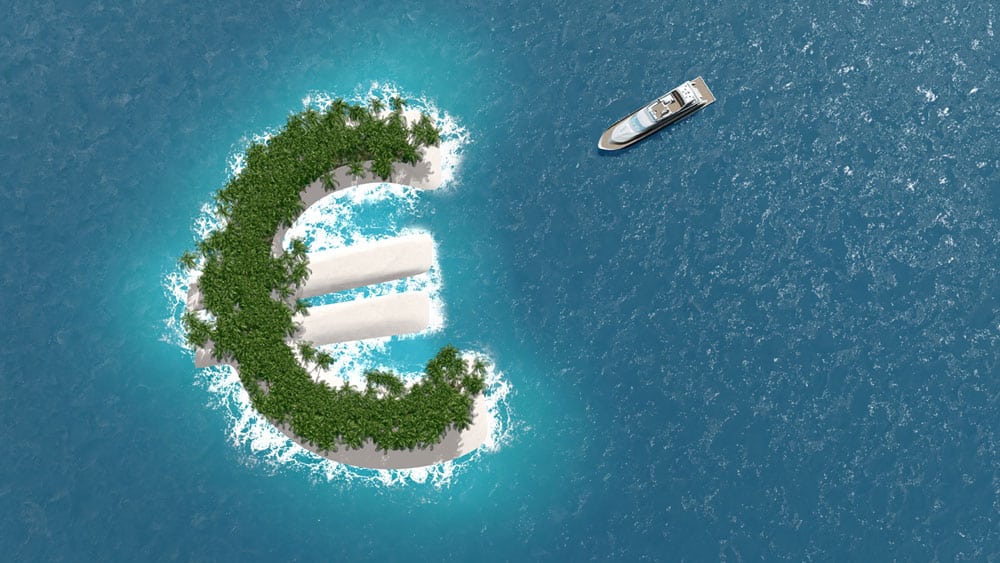

The implications of these two pieces of legislation on the financial planning of expatriates cannot be ignored. In short, it means that the concept of ‘offshore’ with regards to banking and asset holding is now a thing of the past.

The CRS, which was created by the Organisation for Economic Cooperation and Development (OECD), relates to the automatic exchange of information from Reportable Accounts between the jurisdictions that have signed up to the scheme. In regards to what is considered a Reportable Account, the OECD hasn’t outlined specific criteria and instead have left it up to each jurisdiction to determine what qualifies as a Reportable Account.

The CRS was implemented within the EU on the 1st January 2016, and ultimately created with the intention of eliminating any and all places for those attempting to avoid their tax obligations, thereby forcing them to become compliant with the necessary tax regulations sooner rather than later. The information to be exchanged with the CRS, therefore, would be anything which could be of interest to a tax authority keen to identify whether or not a person is committing tax evasion.

The CRS is of particular interest to any expats living in Spain and that have failed to submit a Modelo 720 (the foreign asset declaration). The old justification for not submitting a Modelo 720 – because Hacienda were unlikely to find out about assets held outside of Spain – can no longer be said to hold much truth anymore, mainly because Hacienda should now already be automatically informed of that information.

With all of this being the case, it has never been more important to seek professional financial advice. The consequences of not complying with the latest tax legislation could be dire. Ensuring that your financial affairs are all set up in a tax efficient manner and, more importantly, in a legally compliant manner, could not only save you a huge headache, but also save you from a potentially crippling tax bill.

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.

were digesting news of a major leak of confidential and reportedly revealing documents from a Panamanian law firm. Some are calling it the biggest leak of confidential information ever to hit the global financial services industry.

were digesting news of a major leak of confidential and reportedly revealing documents from a Panamanian law firm. Some are calling it the biggest leak of confidential information ever to hit the global financial services industry.