What is APP fraud?

An APP scam is when a fraudster dupes a victim into making a large bank transfer into their account.

APP scammers typically pretend to be the victim’s bank, building society, pension provider or other trusted organisation. They usually exert pressure, claiming that there is an urgent need for the transfer of money to occur quickly.

The scam victim then authorises the payment/transfer and the money is directed into the scammer’s account.

What did the Treasury Select Committee say?

Rushanara Ali MP, led the Committee and commented, “With scams getting ever-more sophisticated, it’s clear that economic crime is a serious and growing problem in the UK.

“To ensure that consumers are protected, it should now be compulsory for financial firms to reimburse money lost to victims of Authorised Push Payment fraud, and they should consider doing so retrospectively.

“There should also be a mandatory 24-hour delay on all first-time payments, allowing consumers time to consider the risk that they are being defrauded.

“The Government and regulators should take on board all of the Committee’s recommendations to enhance consumer protection in the face of this harmful tide of criminal activity.” **

Avoiding APP fraud

Your bank, building society or other financial institution will almost certainly be able to provide specific information about how you can avoid fraudsters. However, as a general rule of thumb you should never transfer money from your bank or building society account, expat pension fund or other cash source without first ensuring that you have verified the transaction’s necessity.

Furthermore, never rely on emails, texts or unsolicited phone calls; genuine providers will never facilitate or demand a transaction via these methods and they will never ask you for your pin or identification details if they have contacted you.

Lastly, if you are an expat, you may face additional levels of uncertainty when faced with a possible APP scam. This is because, being outside of the UK, you may have additional concerns; scammers may sense this and look to exert additional pressure. You should never rush a payment; always double check the details of the request independently with your institution before making a transfer.

Secure your future wealth with Blacktower FM

Blacktower Financial Management works to ensure that our clients have the tools, knowledge, products and advice they need to meet their and expat pension and retirement goals.

For more information about saving for your retirement, structuring, securing and growing your wealth, including any cross-border assets, contact your local Blacktower office today.

*https://www.ukfinance.org.uk/system/files/Half%20year%20fraud%20update%202019%20FINAL.pdf Accessed 28-11-19

** https://www.parliament.uk/business/committees/committees-a-z/commons-select/treasury-committee/news-parliament-2017/economic-crime-report-published-19-20/ Accessed 28-11-19

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.

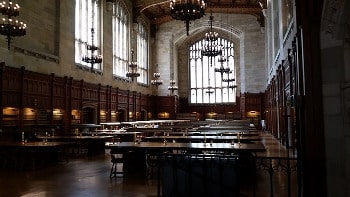

Education and school fees planning is a major concern for any person looking to provide the best opportunities in life for their children or grandchildren. It’s a serious enough burden whoever and wherever you are in the world, but if you are one of the several million British expats living abroad, the issue can seem particularly daunting.

Education and school fees planning is a major concern for any person looking to provide the best opportunities in life for their children or grandchildren. It’s a serious enough burden whoever and wherever you are in the world, but if you are one of the several million British expats living abroad, the issue can seem particularly daunting. British expats with regular savings could soon have to make applications for long-term residency visas if they wish to begin living in the European Union following Brexit, according to sources within the Home Office.

British expats with regular savings could soon have to make applications for long-term residency visas if they wish to begin living in the European Union following Brexit, according to sources within the Home Office.