A view from a professional: investing in a volatile market

Having given financial advice for well over a decade and seeing many cycles of market uncertainty, I thought it would be good to share my experiences and hopefully this article is going to highlight what things you need to consider and understand when saving and more specifically, investing in a volatile market.

Volatile market meaning

It might sound frightening, but a volatile market is simply one which tends to move a lot, and often heavily. This means stock prices regularly rise and fall, which allows investors to take risks. Importantly, if you’re inexperienced in handling the most volatile markets, it’s always advised that you communicate with an expert. Rather than continuing to see your savings make negligible gain, you might choose to begin investing in volatile markets as a means of improving returns.

Option strategies for volatile markets

When investing in volatile markets, you can either choose to put your money into stocks, which give you a piece of a business, or options, which just give you the right to buy and sell your share. Options can be perceived to be less risky than stocks because you’re not paying for equity.

Before we go into the varying option strategies for volatile markets, it’s important to understand that a ‘call option’ gives an investor the right to buy while a ‘put option’ gives a buyer the right to sell. Additionally, a strike price is that at which a put or call can be exercised. As far as options strategies go, you should consider:

- Strangle

In practice, a strangle is when an investor purchases both call and put options. The call is higher than the asset’s market value while the put is lower. Because you’re backing both camps, the risk is limited. A strangle is most profitable if you predict sharp movement in the near future, but you’re unsure which direction.

- Straddle

A straddle is similar to a strange, except the fact that an investor is purchasing call and put options at market value. This is a profitable strategy as soon as the price moves above or below the premium paid.

It’s difficult to judge volatile market conditions

Understandably, a number of my own clients (and most new enquires that I have received recently) have asked for my personal view on whether they should ‘liquidate’ their investment portfolios before reinvesting when a volatile market troughs.

While in theory this makes perfect sense, the problem is that nobody possesses a crystal ball (I certainly wouldn’t be writing this article if I did) and timing a volatile market is near on impossible, even for Investment Managers and traders that review portfolios and volatile market conditions s all day, every day.

Implementing risk factors when investing in volatile markets

Periods of economic downturn and uncertainty are not as infrequent as you might think and any good Financial Advisor will build in “risk factors” when giving you saving advice and guidance around investing in the most volatile markets. Two key areas that must be built into any financial planning objectives are:

1. The term of the investment i.e. how quickly do you need the money back?

2. Your “attitude to risk” i.e. do you want very limited risk, or do you prefer a high risk/high reward strategy or indeed, somewhere in-between?

By mutually agreeing the above from the offset, you can mitigate a lot of potential problems and upset further down the road. Similarly, by remembering these points (which should always be documented in writing), and taking into account the next few sections, you should have the confidence to keep investing in volatile markets, even when it may seem like Armageddon is just around the corner.

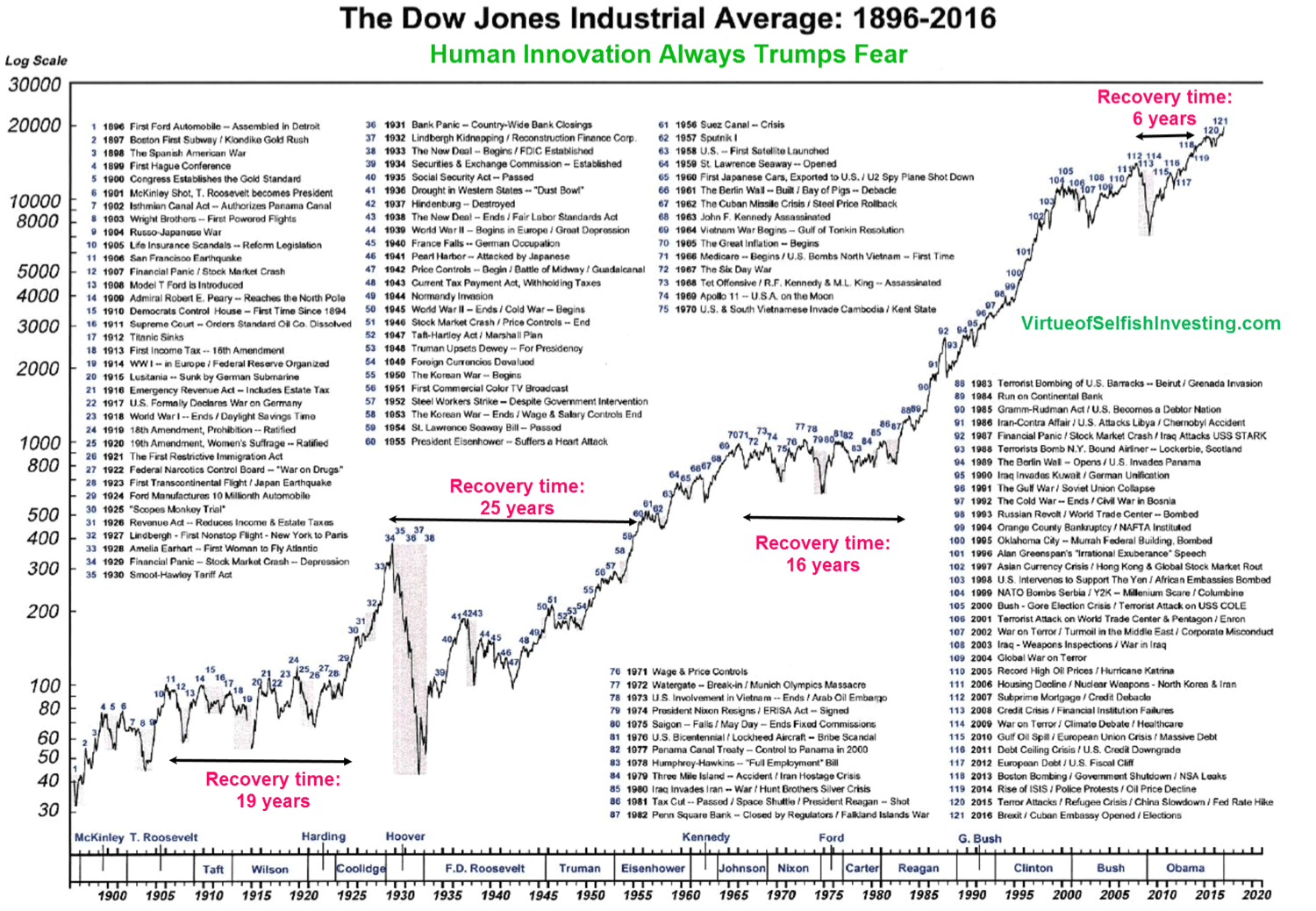

Whilst the above graph is specific to a US index, it highlights that over any long-term period, markets always correct themselves and the long-term trajectory is always positive once a recovery has taken place. This is important to remember if you have an investment in a volatile market.

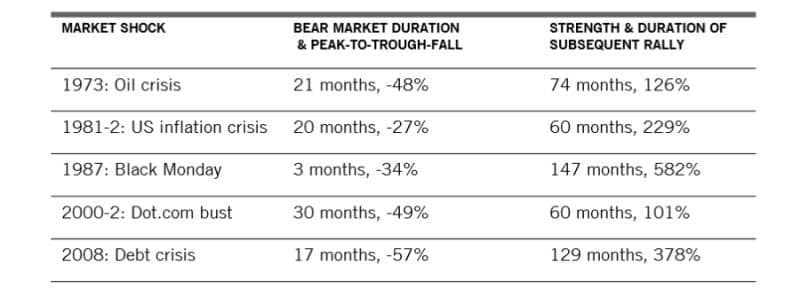

We can look at this more closely from a global market perspective for the last five major downturns:

What should you do if you’ve invested in a volatile market?

Unless it is absolutely necessary, an investor under normal circumstances should not sell their investments during a period of market downturn and volatility. Doing so only means losing money and any perceived loss.

In addition, the recovery of volatile market conditions can happen so quickly that even failing to “time the market”, can have a substantial impact on the level of growth. In summary, “timing the market” is more often than not likely to fail so this would almost never be my recommended strategy.

As Warren Buffett says “Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.”

Can a volatile market ever be a good thing?

Put simply, even the most volatile markets can be a good thing: for those of us that are (or intending) to start investing an amount of money each month, volatile markets are exactly what we want.

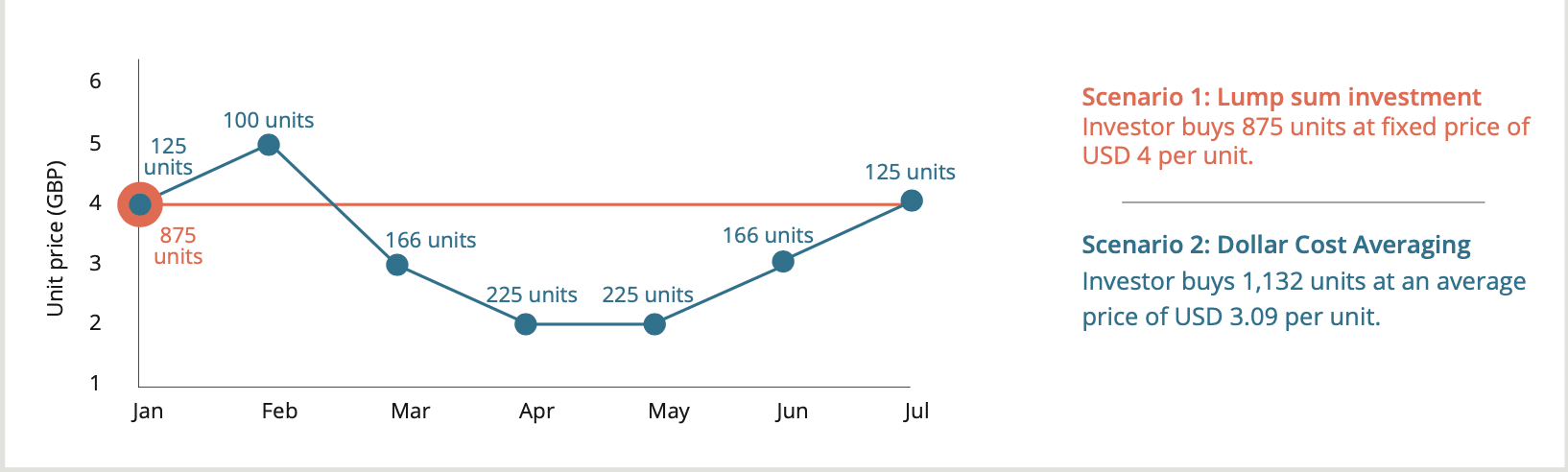

Here is why: the principle of “Unit Cost Averaging” (also referred to as “Dollar Cost Averaging”).

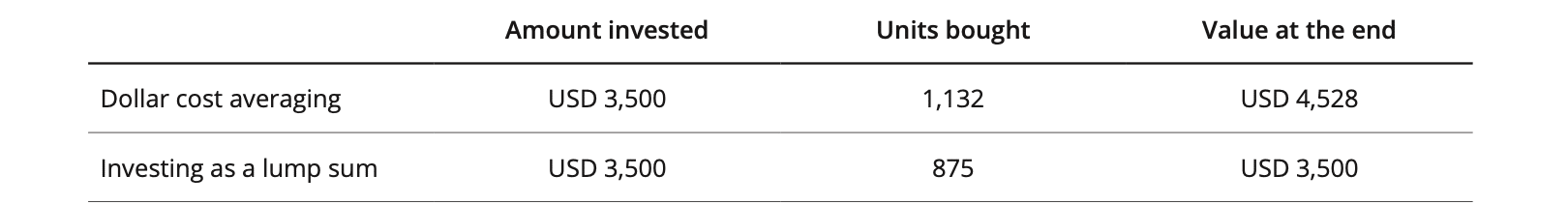

To keep figures simple, let’s look an investment of £3,500 over a 7-month period.

Scenario 1 – The client invests £3,500 day one

Scenario 2 – The client invests £500 per month over a period 7 months (£3,500 total investment)

As you can see, under scenario 2, the client has much more value at the end even though during the 7-month period (also known as “term”), the unit price went down – this is exactly the same as what happens across volatile markets. Now imagine this same scenario over 5, 10, 15 or even 20 years.

The future of investing in volatile markets

Of course, investing in a volatile market is something that is impacted by your own personal circumstances. However, from experience, more often than not, the reason why people delay planning for their own future is due to a poor understanding of what is being recommended to them.

This is purely the fault the of the advisor, but few people realise what the actual cost of delay could mean to them!

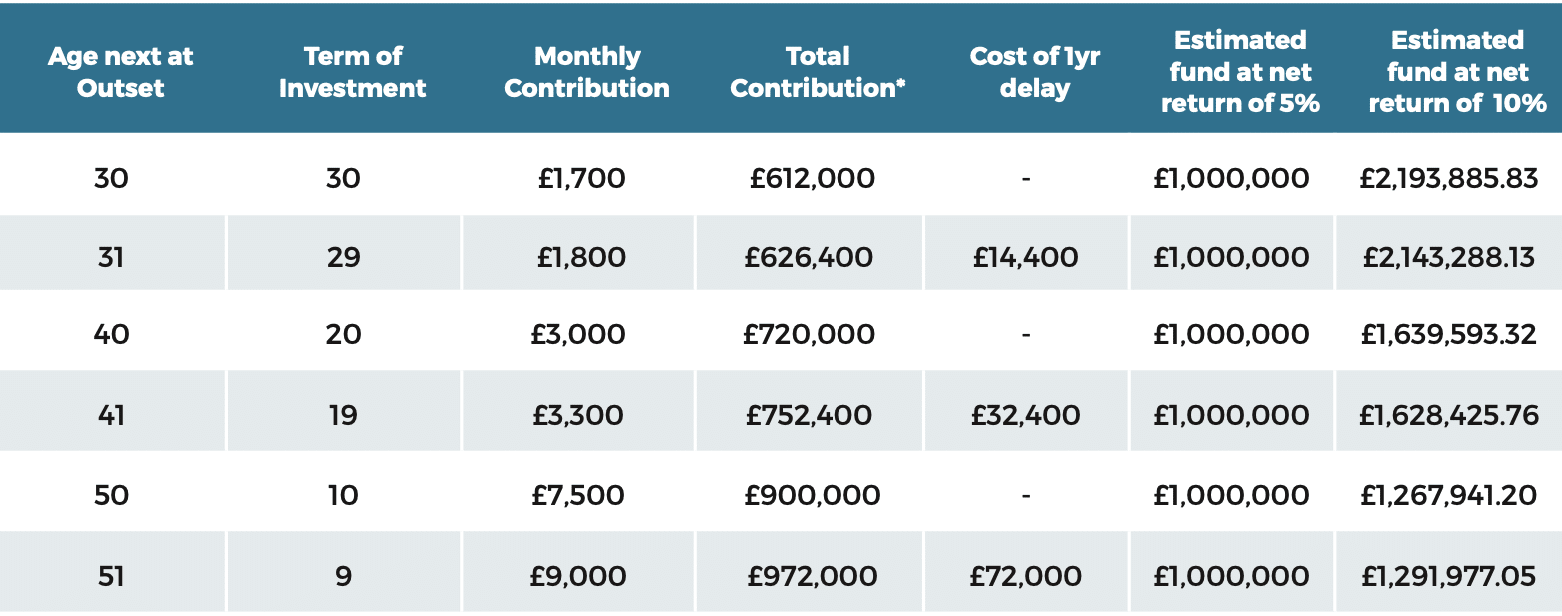

The above table assumes that a couple wants to achieve a total fund of £1,000,000 by the time they are 60 for their retirement.

The figures in the table speak for themselves, with clear financial cost to the couple after delaying for just a year. If you have the means of investing in a volatile market on a more regular basis, you should adopt the practice early.

Granted, this amount may sound like a lot of money to most people but in fact, when you consider life expectancy, this £1,000,000 equates to around £40,000 per annum based on today’s cost of living. Factoring inflation in as well over the next X amount of years and the value looks a little less unrealistic.

How Blacktower can help you invest in volatile markets

When investing in a volatile market, whether to either improve the return on your savings or give yourself a positive platform in retirement, it’s important to discuss the likes of compound growth, inflation, and retirement shortfall calculations with your advisor.

More generally, The Blacktower Group was formed in 1986 to provide independent wealth management advice and a bespoke service for both individual and corporate clients.

We can assist you with;

- Saving and Investments

- Retirement Planning

- UK Pensions

- Cross border Tax Planning

- Life and Health Insurance

To speak to myself or one of my team about any of the above and how we can assist you now, or in the future, please get in touch.

I hope you found this article of interest and hope to speak to you in the future.

Luke David Hunt

Associate Director

- Visuals source : Providence Life and Virtue of self-investing

- Blacktower Financial Management (International) Limited is licensed by the Gibraltar Financial Services Commission. Licence Number 00805B

Disclaimer: This communication is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice form a professional adviser before embarking on any financial planning activity.”

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.

Let’s face it: Brexit is a confusing time for everyone. However, it is important that panic doesn’t set in. This applies at every level, from the uppermost echelons of government and business leaders to expatriate workers and the everyday retiree.

Let’s face it: Brexit is a confusing time for everyone. However, it is important that panic doesn’t set in. This applies at every level, from the uppermost echelons of government and business leaders to expatriate workers and the everyday retiree. VACANCY – Senior Compliance Officer

VACANCY – Senior Compliance Officer