Over 60% of Britons are feeling stressed over their financial position

The UK has been one of the world’s hardest hit countries in terms of COVID cases, so it’s no surprise that this uncertainty has triggered more financial worry in 61% of Britons than before the outbreak. By city, Bristolians are the most worried about their finances (66%), while those based in Birmingham (63%) and Cardiff (60%) are a close second and third, respectively.

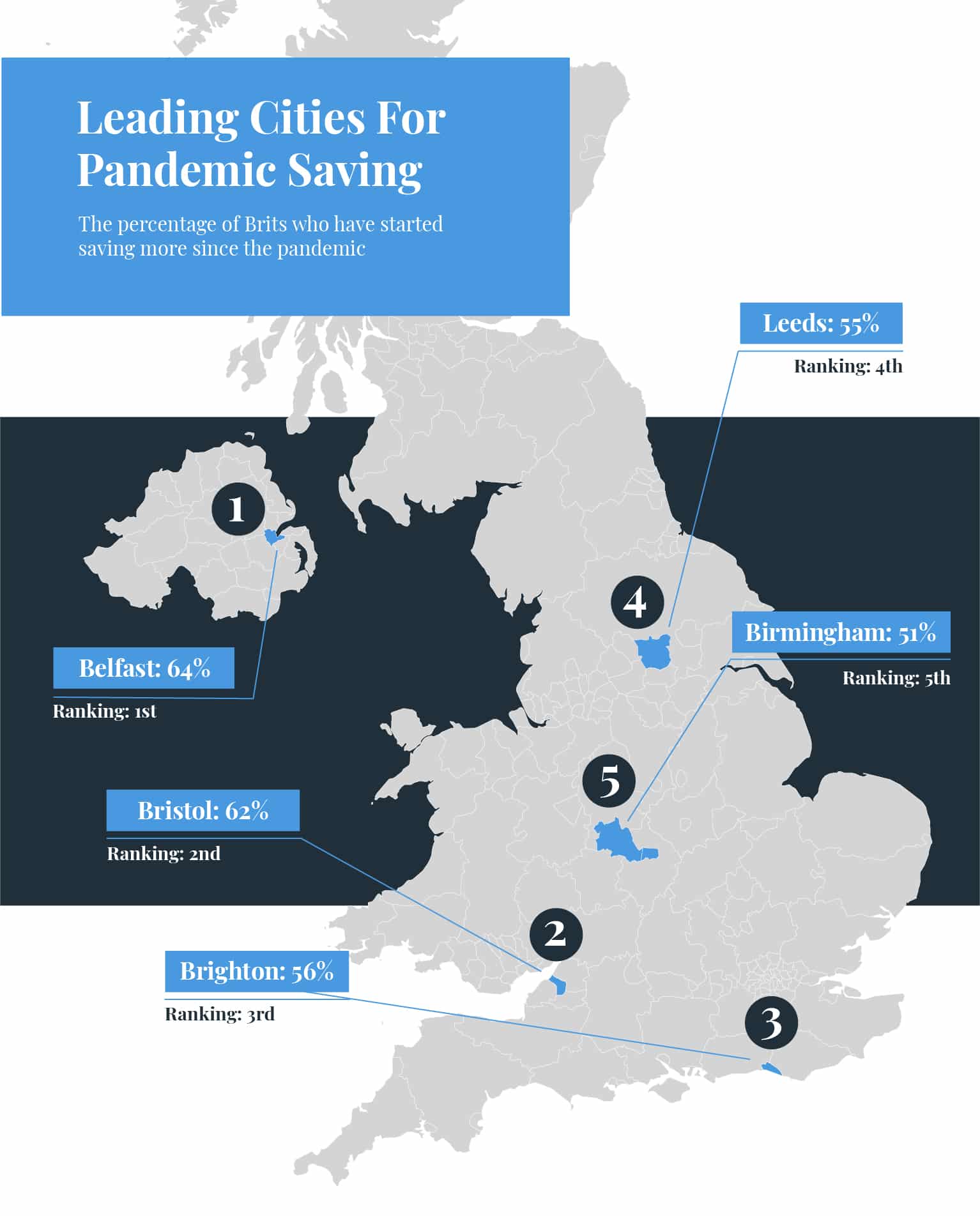

Belfast the leading UK city for pandemic saving

With the worst yet to come, and long-term recession and tax implications yet to be fully determined, the pandemic has prompted 54% of Britons to save more money than usual each month. Leading the way, the people of Belfast have started saving more than any other UK city (64%), with Bristolians (62%) and Brighton-based Brits (56%) rounding off the top three.

Similarly, there’s also been a huge change in attitude towards spending, with over half of Britons (53%) treating the pandemic as a wake-up call and choosing now as the right time to get their personal finances in order, and nearly 60% changing their spending habits for the better.

Nearly three quarters of Spaniards are worried about their finances

The pandemic has been a cause for concern for many Spanish residents, with 71% now more worried about their personal accounts. Residents of Murcia (88%), Barcelona (85%), and Malaga (85%) are the most worried, while 73% of those living in capital city Madrid are also feeling the stress.

Malaga tops the charts for Spanish savers

The emergence of COVID has certainly caused a shift in attitude towards personal finances, with 61% of Spaniards considering the pandemic to be a wake-up call, 62% changing their spending habits for the better, and 65% now choosing to put a little more money aside each month to combat the long-term implications of an imminent recession.

Breaking it down by city, 77% of those living in Malaga are now saving more than they were at the beginning of 2020, followed by Alicante (76%) and Murcia (72%). Not far behind, 68% and 60% of those living in major hubs Barcelona and Madrid, respectively, have now started to save more.

Four-in-five Portuguese express concern over personal finances

Residents in Portugal have certainly felt the financial impact of COVID, with 80% stressed about their financial position. Those in Queluz are particularly concerned, with 85% expressing worry, while the people of Cacem (84%) and Braga (83%) are close behind.

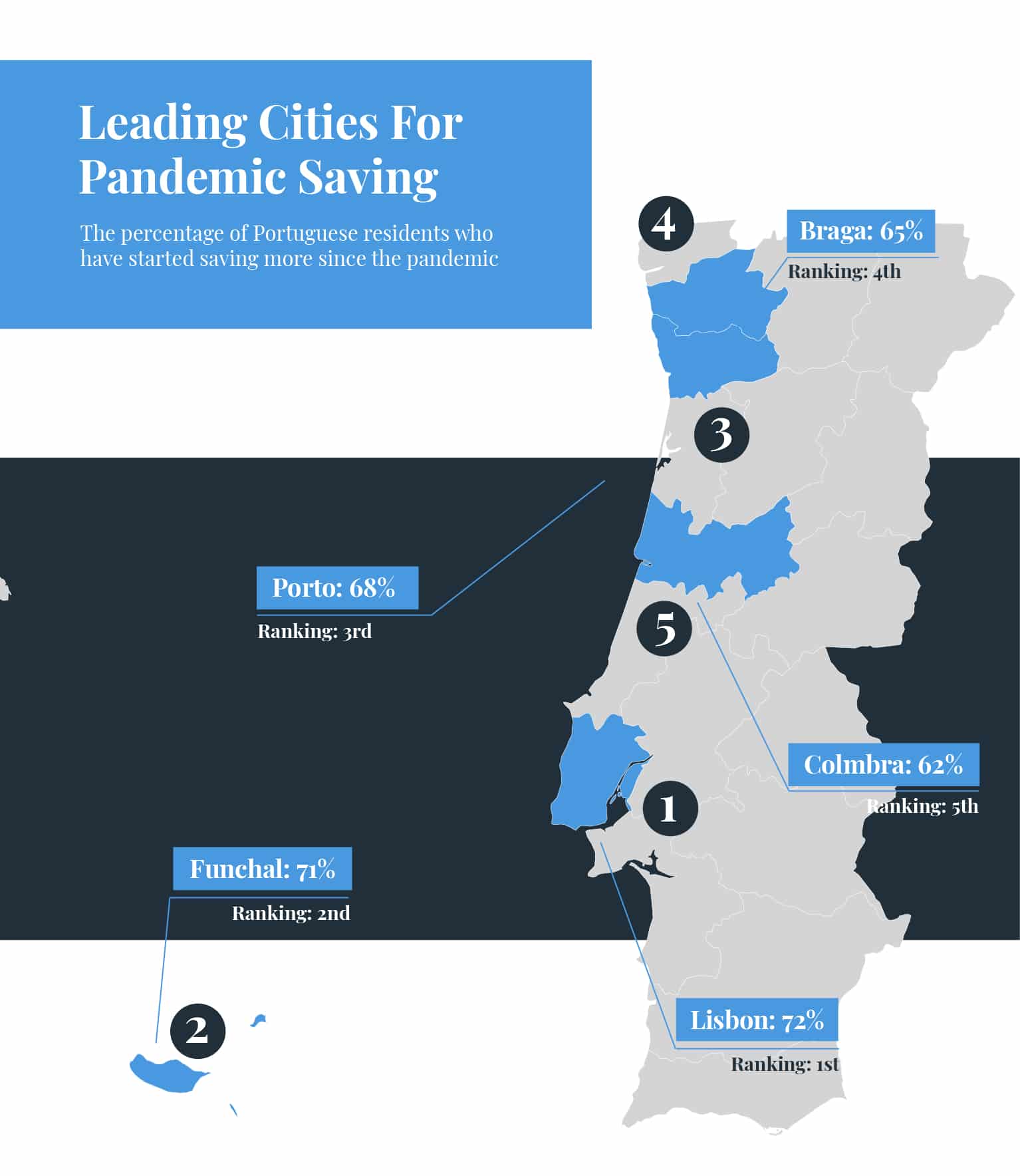

People of Lisbon are Portugal’s most prolific savers

For 65% of Portuguese residents, the pandemic has proven to be a wake-up call, and 70% of nationals are choosing to make positive changes to their spending habits. To combat the yet-fully-determined financial implications of the pandemic, 65% have decided to start saving a little more money each month. The people of Lisbon are leading by example with 72% topping up their monthly savings, while those living in Funchal (71%) and Porto (68%) are following suit.

As the latest set of obstacles brought about by the pandemic present themselves, it’s important to recognise the ways you can prepare yourself financially. Discover the latest from us, including even more expert advice around making your finances go further.

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.

As an expat myself, I have been keeping a close eye on the news relating to the British people’s decision to seek an exit from the EU. Our newspapers are filled to the brim day in and day out with commentary from the ‘Brexiteers’ and ‘Remainers’. Everyone seems to have an opinion as to what will take place, how it will look and what actions you need to take – but the basic facts at this moment in time are that ‘we don’t know’ – it is all speculation.

As an expat myself, I have been keeping a close eye on the news relating to the British people’s decision to seek an exit from the EU. Our newspapers are filled to the brim day in and day out with commentary from the ‘Brexiteers’ and ‘Remainers’. Everyone seems to have an opinion as to what will take place, how it will look and what actions you need to take – but the basic facts at this moment in time are that ‘we don’t know’ – it is all speculation. By now you are probably really fed up hearing about Brexit! Yet, it’s important that you are prepared financially; not just for a Deal or NO Deal Brexit, but also by being ready to meet the Spanish requirements for living in the country.

By now you are probably really fed up hearing about Brexit! Yet, it’s important that you are prepared financially; not just for a Deal or NO Deal Brexit, but also by being ready to meet the Spanish requirements for living in the country.