We are one of the most comprehensive and experienced wealth management companies around and our range of holistic financial planning services covers all your needs whether you are in the world.

Recently named Best Travel Destination in 2022 by Condė Nast travel magazine, Portugal continues to attract more interest from expats than any other European country.

Offering a wide variety of locations to move to that cater to a host of different lifestyles, it perhaps comes as no surprise that an increasing number of digital nomads and holidaymakers are looking to permanently move to Portugal from the UK. However, there’s no doubt that the moving process can be complicated, despite being worth it in the end.

As with any destination, inadequate financial planning when looking at how to move to Portugal from the UK can result in stress, fines, and costly consequences further down the line.

Laws and legislation regarding moving to Portugal after Brexit in particular can often differ from region to region, making it easy to be caught out by local variations in fiscal policies.

But the good news is that, here at Blacktower, we’re equipped with the understanding, knowledge, and regulatory footprint necessary to make the transfer of your personal financial arrangements for your move to Portugal as effortless as possible.

With our holistic range of financial planning services, our experienced advisers can help you with everything, from inheritance planning to Portuguese mortgage advice, allowing you to relax, knowing that your finances are in good hands.

With that in mind, here is what you need to know about how to move to Portugal from the UK.

Moving to Portugal from the UK

Many expats move to Portugal to enjoy the year-round sunshine, delicious food, and breath-taking beaches. The cost of living is also relatively low when compared with other EU countries, making it an extremely attractive option.

An estimated 480,000 expats live in Portugal, 60,000 of which are from the UK, with many wishing to take advantage of the country’s pension taxation rates. Move here, and as a non-habitual resident, you won’t be taxed on your pension for your first 10 years in the country, and following that, are only taxed at marginal rates.

Whether you wish to move to Portugal to work, bring your family up or retire; make the most of your time in the country by enabling us to help you with your future financial plans.

What are the benefits of living in Portugal?

The cost of living in Portugal may be low, and the tax rates favourable, but that’s not the only reason why expats flock to this beautiful country. In fact, there are several benefits to moving to Spain’s neighbour.

300 days of sunshine a year

It’s claimed that Portugal enjoys 300 days of sunshine every single year, which is a stark contrast to the weather in the UK. The summers are hot, and the winters mild – daily temperatures are usually between 10-16 degrees Celsius, although the coastal towns tend to get quite wet. As such, expats can enjoy an outdoor lifestyle year-round.

Friendly locals

One of the most daunting parts of relocating to a different country, is the ability to make new friends. The Portuguese are extremely friendly and hospitable, and are often very happy to speak to expats. If you live next to a Portuguese family, expect to be invited to spend long, lazy afternoons together, sipping coffee.

Beautiful beaches

Boasting more than 850km of coastline, Portugal has a vast array of beautiful sandy beaches – which aren’t just confined to the Algarve. From long, sandy stretches and shallow waters, to hidden coves, dramatic cliffs, and choppy waters ideal for a wealth of water sports; the beaches are as varied as the country itself.

Portuguese tax planning

Although there are many incentives to move to Portugal, it’s always worth bearing in mind the potential tax implications of taking such a step. Despite your move, there is still a range of different Portuguese taxes you could be liable to pay once you’ve moved, such as:

- Wealth Tax

- Income Tax

- Capital Gains Tax

- Property Tax

- A Solidarity Tax for high earners

Naturally, which taxes are applicable to you will depend on your financial circumstances and residency status.

While national deals, such as Double tax treaties, can alleviate some of your liability and help establish better efficiency in your taxation, it’s always a good idea to seek advice on your circumstance from local experts.

Portuguese residency

Much of your tax liability and other financial commitments in Portugal will depend on whether or not you’re classed as a resident. Therefore, it’s important that you establish whether or not you’re eligible for Portuguese tax residency as early on as possible to avoid paying over or under your tax liability.

Generally speaking, anyone living in Portugal will qualify as a Portuguese resident if they spend at least 183 days a year in Portugal over the course of the year, or if their primary residence is located in Portugal.

If applicable, Portuguese Income Tax rules may also include split-year residency; this means your tax liability is directly linked to your physical presence in Portugal, beginning on the first day of your stay and terminating on the day your stay ends.

Portuguese inheritance tax

Like both Spanish and UK inheritance tax, the process for dividing your estate up between your beneficiaries can be complex in Portugal. When passing on Portuguese property in particular, your beneficiaries are liable to pay stamp duty.

However, it may be possible to avoid this when gifting property to your children or other direct beneficiaries. This can be done in a range of ways but what’s best for one person may be disadvantageous to the goals and circumstances of another.

When it comes to Portuguese inheritance, we definitely recommend seeking out financial guidance to make the process simpler.

Portuguese investment tax

Last, but not least, in order to maximise your tax efficiency as an expat moving to Portugal, you may find it necessary to change how your investments are structured due to different investment types being taxed differently across the country.

Be sure to consider the tax efficiency of the following investments before you start your move:

- Equities

- Unit Trusts

- Open-Ended Investment Companies Investment Bonds (OEICs)

- Pension Income

- Rental Income

Can I move to Portugal without a visa?

Along with the potential financial complexities associated with moving to Portugal after Brexit, non-EU citizens need to apply for a Residency Visa or a Temporary Residence Permit in order to live in the country for a lengthy period of time.

The former visa allows applicants to move to Portugal before registering as a resident, giving them four months to register with the SEF and receive a Temporary Residence Permit.

Once approved, this visa allows applicants to stay in the country for two years, which can be extended for another year annually up to a limit of five years. After this visa expires, you can then apply for permanent residency.

Visa Types and NHR

There are three primary types of Residency Visas available in Portugal.

- Golden Visa (primarily for investors)

- D7 Visa (primarily for retirement or those living off investments abroad)

- D2 Visa (primarily for entrepreneurs)

The NHR scheme is designed to offer tax breaks to foreign residents. The scheme offers incredibly beneficial tax advantages to both first-time residents and those who have not been residents in Portugal for the past five tax years.

Best cities to move to in Portugal

Expats who are moving to Portugal will need to decide where to settle. Offering a mixture of big cities, charming towns, and quaint seaside resorts; there’s an area in Portugal to suit every lifestyle.

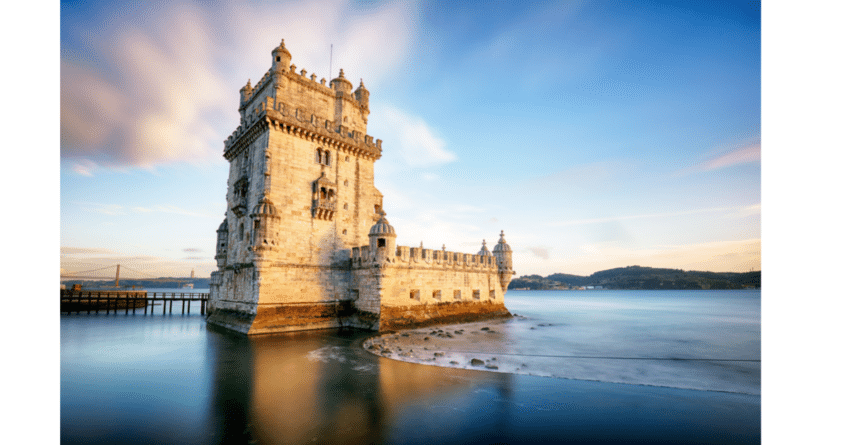

Lisbon

- Pint of beer: 2 EUR (£1.80)

- Cappuccino: 1.62 EUR (£1.47)

- Meal in a restaurant: 8 EUR (£7.23)

- Monthly public transport pass: 40 EUR (£36.17)

- Population: 504,718

Expats move to Lisbon due to the vast employment opportunities in the property, IT, and aerospace industries. When choosing where to live in Portugal’s capital, Bairro Alto and Avenidas Novas are popular amongst professionals, whereas Alfama – the oldest neighbourhood in the city – is a favourite with families.

Lisbon offers an excellent quality of life for expats. The bright, warm sunshine means you can make the most of the great outdoors, with several beautiful beaches located just a short drive away. If you choose to stay in the city during your weekends and days off; visit St. George’s Castle, ride on one of the quaint trams, and sample a world-renowned Pastéis de Nata.

Faro

- Pint of beer: 2.25 EUR (£2.70)

- Cappuccino: 1.90 EUR (£3.05)

- Meal in a restaurant: 9.50 EUR (£15.30)

- Monthly public transport pass: 32 EUR (£25.65)

- Population: 58,664

Those who want to move to Portugal and enjoy a relaxed pace of life, move to Faro. The capital of the Algarve, Faro still offers a city feel, but is surrounded by beautiful countryside.

With countless beaches and numerous golf courses located throughout the region, relocate here, and you’ll get to enjoy a relaxed outdoor lifestyle. The city of Faro is also well connected with the rest of Portugal, with several internal flights to Lisbon and Porto, as well as flights to large cities in Spain.

Whilst the Algarve is seen as a popular retirement destination, there are still many employment opportunities available – most notably in the construction, retail, and tourism sectors.

Porto

- Pint of beer: 2 EUR (£1.80)

- Cappuccino: 1.58 EUR (£1.42)

- Meal in a restaurant: 7 EUR (£6.30)

- Monthly public transport pass: 35 EUR (£31.45)

- Population: 214,349

Located in northwest Portugal by the coast, Porto is renowned for its wine production – in fact, the Douro Valley has produced port since the 17th century.

The Douro river runs right through the heart of the city, by the winding cobblestone streets of Ribeira, which are lined with colourful houses, and quaint coffee shops and restaurants. The beaches are just a tram ride away too, and despite having a city feel, Porto has a much more laid-back atmosphere.

Foz de Douro is a popular area for expat families to settle, whereas professionals prefer Vila Nova de Gaia, which boasts some of the best restaurants – and views – in the city.

Managing your finances in Portugal

With offices in Lisbon and the Algarve, we strive to ensure that all of our clients receive sound financial advice and products that are beneficial for them.

Whether you want to find out more about international pensions, such as QROPs or SIPPs advice, or help with tax planning and inheritance rules, we’re here to help. We can also help you to navigate any bureaucratic issues or cultural differences; with our expert team dedicated to helping you meet your objectives.

To get in touch, simply fill out the form above; or call our Lisbon office on +351 214 648 220, or the Algarve team on +351 289 355 685. Alternatively, find out more about moving to Portugal with our guides on Portuguese residents with UK pensions, and the benefits of life assurance in Portugal.

Moving abroad can be overwhelming, regardless of how familiar you are with your chosen destination. Thus, in order to secure a robust financial future for yourself and your family, financial planning is essential.

To get the most out of your savings and provide yourself with peace of mind, get in touch today with one of our experienced Blacktower advisers to start protecting your horizon in Portugal.

And if you want to find out more about international pensions, such as QROPs or SIPPs advice, or help with tax planning, our expert team can help. Alternatively, you can find out more about moving to Portugal with our free guides on moving abroad as an expat and the benefits of life assurance in Portugal in the relevant areas of our website.