Several companies have been bidding to buy other companies and have even had generous offers turned down. Premier foods are a good example of this; its share price spiked 50% to 46p from 31p after a second offer of 60p per share was turned down to buy the company outright. Many companies are cash rich at the moment and more expansion and takeover bids can be expected. The FTSE has also moved to over 6150 since dipping below 5800 during the last couple of months. Dividends continue to increase generally; this may have been just a sweetener for investors as their holdings have fallen in value, but if recovery does continue to happen, watch out for some spectacular returns.

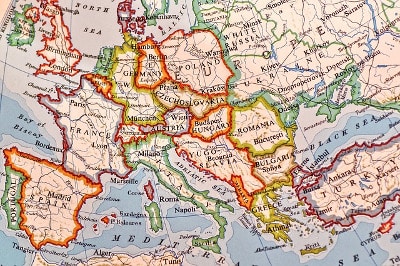

Brexit speculation will continue to dampen in the short term but indicators are looking very good for the summer. Shrewd investors looking to spread and diversify their investments among strong companies with high dividends or funds that specialise in this type of company share could really provide good value for the investor at long last.

When looking at what interest rates are giving at the moment, now might be the time to sit down and review your investment and savings and even view the markets with some optimism as the potential upside is huge. Just think, if oil continues its upward surge along with the markets and a Brexit does not occur you might be kicking yourself in July for not reviewing things now.

In today’s financial climate it is essential you do everything you can to make sure your money is safe and secure to ensure you achieve your financial aspirations for the future.

I have been a fully Qualified Financial Adviser for 28 years and understand the needs of expats and the rules that apply to British people living and retiring in Spain. So, if you need to talk through your own situation then please feel free to contact me and we can have a no obligation discussion about the best way forward for your investments. Find out more about our wealth management services here.

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.

Last year the Association of British Insurers (ABI) provoked something of a panic among British expats in Europe. Those who in some way rely on insurance products, such as annuities and life insurance, for the payment of income and expat pensions were understandably alarmed when Huw Evans of the ABI said that a no-deal Brexit could leave insurance contracts in legal limbo because of a risk that payments could not be fulfilled for contracts written pre-brexit. (

Last year the Association of British Insurers (ABI) provoked something of a panic among British expats in Europe. Those who in some way rely on insurance products, such as annuities and life insurance, for the payment of income and expat pensions were understandably alarmed when Huw Evans of the ABI said that a no-deal Brexit could leave insurance contracts in legal limbo because of a risk that payments could not be fulfilled for contracts written pre-brexit. (