What happens when a pension plan is frozen?

When a pension plan is frozen, it doesn’t increase in value. This could be for a couple of reasons. For example:

1. You have moved abroad

A state pension received by a UK expatriate who has retired overseas is frozen on the day he or she lands in the new country of residence if that country is outside of the EEA. It will not increase with inflation as it would have had the pensioner remained in the UK or EEA. This is true in the case of people who have emigrated to Australia, New Zealand or Canada for example.

2. You have moved workplace

One way of defining a frozen pension is that of a workplace pension established through a previous employer. When an individual leaves an employer to take a job with a new one, any pension that is older than two years remains intact unless the employee explicitly chooses to transfer it elsewhere. Leaving a pension behind in this way is sometimes described as a “frozen pension”, although the correct term is a “deferred pension”, as neither the employer nor the former employee continues making contributions. However, importantly, it’s not truly frozen as the invested funds can continue to earn returns for as long as they remain invested; or in the case of “final salary schemes” they will increase annually to account for inflation.

What to do with a frozen pension

Pension schemes can continue to exist even if the original employer has gone out of business, changed name, or was bought by another company. The pension scheme is run separately from the company and quite often is administered by a pension administration or insurance company.

If you’re wondering what to do with a frozen pension, beyond leaving it in its current form, consider the following:

- Most pensions will allow you to transfer your pension pot to another pension scheme (perhaps a new employer’s workplace pension scheme), a self-invested personal pension (SIPP) or a qualifying recognised overseas pension scheme (QROPS). If you have several pensions they can be consolidated into one, thereby saving costs.

- If you have a “final salary scheme” you can request a CASH EQUIVALENT transfer value in order to secure your pension pot. Some of these schemes are looking to reduce their liabilities, and thereby offering enhanced transfer values to get members off their books. In some cases, they could be more than 20 times the value of the annual pension offered on retirement.

How to find frozen pensions

Over the last few decades, there have been many changes in the workplace, including a more migratory and flexible workforce. These days, it is common to move between different employers in search of better pay and conditions.

However, this has caused people to lose track of their pensions, causing them to become “lost”. The scale of the problem is huge — £400 million is estimated to have been left in lost or forgotten pension schemes. However, it is not the employers’ responsibility to keep track of “deferred” members, so if you move address you should inform all your previous pension schemes.

At Blacktower, we are happy to help clients track “lost” pensions. Being able to trace your pensions and collate them into one final amount will enable you to plan for your retirement properly. Most pensions will allow you to transfer your pension pot to another pension scheme, which could be a new employer’s workplace pension scheme, a self-invested personal pension (SIPP) or a qualifying recognised overseas pension scheme (QROPS). If you have several pensions they can be consolidated into one, thereby saving costs.

You don’t have to decide straight away – you can generally transfer at any time up to a year before the date that you are expected to start drawing retirement benefits. In some cases, it’s also possible to transfer to a new pension provider after you have started to draw retirement benefits.

Disclaimer: This communication is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice form a professional adviser before embarking on any financial planning activity.

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.

From

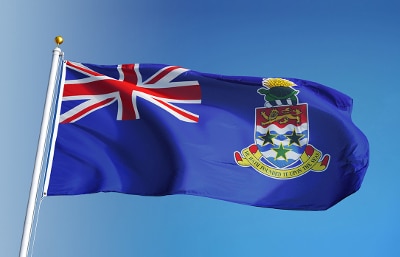

From  The Cayman Islands has a new governor following the announcement that Martyn Roper OBE, a career diplomat and corporate leadership veteran, has been appointed to the role. He takes over from Anwar Choudhury, who had recently faced a number of complaints regarding his conduct.

The Cayman Islands has a new governor following the announcement that Martyn Roper OBE, a career diplomat and corporate leadership veteran, has been appointed to the role. He takes over from Anwar Choudhury, who had recently faced a number of complaints regarding his conduct.