“We want to build the financial capital of the future,” said the PM. “In a word, now is the time to come to France.”

As many consumers of expat financial services in France already know, the French tax regime allows for tax deductions for non-salary benefits – for example, assistance for education fees.

The government also indicated that it would try to create more favourable working conditions for British wealth management firms looking to operate in France.

However, one potential stumbling block is the issue of freedom of movement; France agrees with other EU countries that British financial firms should be allowed to retain free access to EU markets only if Britain remains committed to the principle.

To find out more about how the current climate in Europe could affect your financial future, contact Blacktower today for expert expat financial services you can trust.

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.

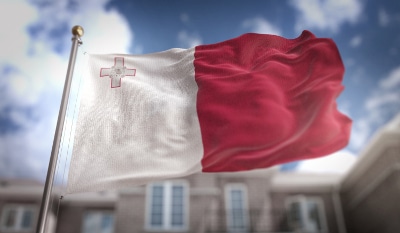

In our “Around the Branches” segment we take a look at some of the concerns affecting our clients and our business in individual locations. This time we are in Malta where the regulatory landscape could be changing for financial services firms operating on the island nation.

In our “Around the Branches” segment we take a look at some of the concerns affecting our clients and our business in individual locations. This time we are in Malta where the regulatory landscape could be changing for financial services firms operating on the island nation.