Some of my colleagues and I have long been advocates of using the services of a Discretionary Fund Manager (DFM), to manage the investment portfolios on behalf of our clients, but of course, only when it meets the client’s needs and is cost effective.

I have for a long time believed being a Financial Advisor doesn’t always necessarily mean that we are skilled at picking funds for a portfolio, although that’s not to say that some aren’t.

I have been recommending the use of DFM’s for over 20 years and a large proportion of my existing clients are invested in this way. The reason for this is that I feel strongly that there is a risk to a financial advisor undertaking the role of the investment advisor unless they have the knowledge and experience to do so.

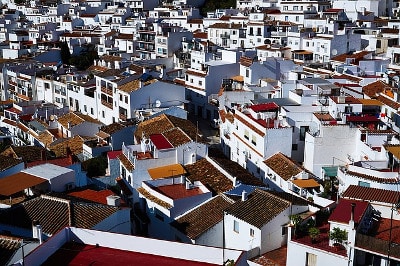

I have now spent over 20 years as an advisor in Spain, where we have a range of providers at our disposal. These all offer a wide range of valuable services and have helped keep my clients safe during both periods of growth and during periods of volatility.

I have previously read articles suggesting using a DFM only adds a further layer of fees, this depending on how your policy is set up maybe true, but I am confident, and experience has shown me, that a small additional fee is probably insignificant when comparing the benefits of what is on offer.

So, what are the benefits:

- Actively managed portfolios with a wide range of funds with institutional pricing.

- Investment experts making the investment decisions.

- Portfolios designed in a range of risk profiles and currencies.

- Low entry costs and annual management charges.

- Portfolios can be held directly or through a Spanish Compliant Bond.

- 24/7 online reporting.

With some DFM’s offering their services with lower initial amounts than some other products, it can also be a good home for those wishing to start a new investment with the option to make further contributions in the future.

If you are looking at a home for your money to offset the rising costs of inflation or you wish to invest funds held in bank accounts, ISA’s, Premium Bonds or hold existing investments which you feel are underperforming, contact me today for further information about our range of DFM providers and how they can help secure your financial future.

For further information please contact David Evans DipFA, at our Costa Blanca office in Spain. Email david.evans@blacktowerfm.com or call 0034 630 244 985 for an informal chat about your circumstances.

This communication is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice form a professional adviser before embarking on any financial planning activity.

Blacktower Insurance Agents & Advisors Ltd is regulated in Cyprus by the Insurance Companies Control Service and registered with the DGS in Spain. Blacktower Financial Management (Cyprus) Ltd is regulated in Cyprus by the Cyprus Securities & Exchange Commission and is registered with the CNMV in Spain

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.

Remember saying “Ready or not here I come”?

Remember saying “Ready or not here I come”? It’s hardly a new revelation to state that Brexit has caused uncertainty for British expats. Until the EU and British government reach a final agreement in Brussels, the lives of many expatriates are certainly in a state of limbo.

It’s hardly a new revelation to state that Brexit has caused uncertainty for British expats. Until the EU and British government reach a final agreement in Brussels, the lives of many expatriates are certainly in a state of limbo.