Markets

It has been another astonishing week, where to recap, the FTSE 100 closed on June 22nd 2016 at 6340, it hit a temporary low on Friday June 23rd of 5780 (down 8.8%). By close of business on Friday June 23rd it had rallied to 6577 (+13.7%). So why the recovery, when the government seems moribund? The initial speeches by Governor Mark Carney last Friday week and Chancellor George Osborne on the following Monday did a fair bit to sooth some very fractious and frayed nerves. Mr Carney went even further in his second speech of the week, saying more QE if required (£250 billion) and potentially a cut in interest rates, if needed, against a background of a deteriorating economic data.

The net result last week saw the FTSE 100 rally by 7.2%, but it should not be forgotten that 65% of FTSE 100 earnings come from Dollar related earnings and we did see a 5% drop in the value of the pound last week and a 12% fall in the last 6 months. Other world indices behaved as follows – S&P up 3.2%, European indices rallied 3.5% and Japan’s NIKKEI by 4.9%. In London it was the mining, energy, tobacco and drug sectors that rallied to the cause (i.e. the dollar earners). Despite credit rating agency downgrades, 10-Year gilt yield fell to 0.86% and Cable settled at $1.3267 on Friday. Gold shot to the top of the class at $1341 an ounce. It is interesting to note that the UK stock market rallied more than those in Europe which had also fallen sharply in the run up to the vote.

Outlook

Any asset price falls, combined with a weakening in sterling, will make UK assets very attractive to foreign investors. It is no surprise that some companies with a high portion of US Dollar earnings, are seeing their share prices go up not down. We have already seen reports that Chinese and Middle Eastern investors are poised to buy UK assets after the fall in Sterling and this could start happening immediately. This is a great advert for UK PLC, that sophisticated foreign investors still regard Britain as an attractive place to invest, no doubt due to our highly flexible economy, rule of law and property ownership rights. Some of the moves in house builders, banks, insurance companies and real estate companies look dramatic and overdone. According to the FT at the weekend, last week saw one over one hundred FTSE 100 & FTSE250 company directors buying shares in their own companies which the paper described as “unprecedented”, showing that the people who run these businesses have confidence in their resilience and that the market overreacted.

Let us also not forget that the UK stock market is one of the highest yielding in the world, in an environment where yield is increasingly hard to find. In addition, government bond yields continue to fall to historic low levels, as a result I believe high quality income bearing quoted companies will become increasingly attractive. We are undoubtedly in for a period of increased currency and stock market volatility, particularly over the summer months, but this creates opportunities as well as headaches. Once again I do not fear the future and am quietly optimistic for the future prospects for UK PLC.

Politics

Let me make a few observations from this week of the political long knives. It does seem likely that Theresa May will be our next Prime Minister. Her silence in the referendum campaign was noticeable, but she is a very well regarded Home Secretary and the overwhelming favorite of the press and bookmakers. Her only issue will be to convince the electorate of the Conservative Party that she has the country’s best interests at heart when negotiating Brexit, given she supported the Remain side. Michael Gove is an intellectual heavyweight and as pointed out by BBC’S James Landale, must have put his speech and ideas together some time ago, as his comprehensive thoughts were surely not cobbled together at the last minute. His campaign is suffering a backlash for withdrawing support from Boris and he will struggle to make the last two as a result which go forward to the membership to vote on. Andrea Leadsom has been the beneficiary of some positive publicity, and looks likely to receive a very decent Cabinet post, but is an outside chance. However it is brave person who can unequivocally interpret the views of a very complex political maze like the Tory party! The country needs leadership at this uncertain time and whoever becomes PM will have to fill this vacuum quickly and decisively. This would be well received by the currency markets in particular.

By far and away the most important development of the week went largely unnoticed, as David Cameron placed Oliver Letwin in charge of the Brexit Unit in the Cabinet Office He is an intelligent and principled politician who was well regarded in the city from his time at Rothschild’s.

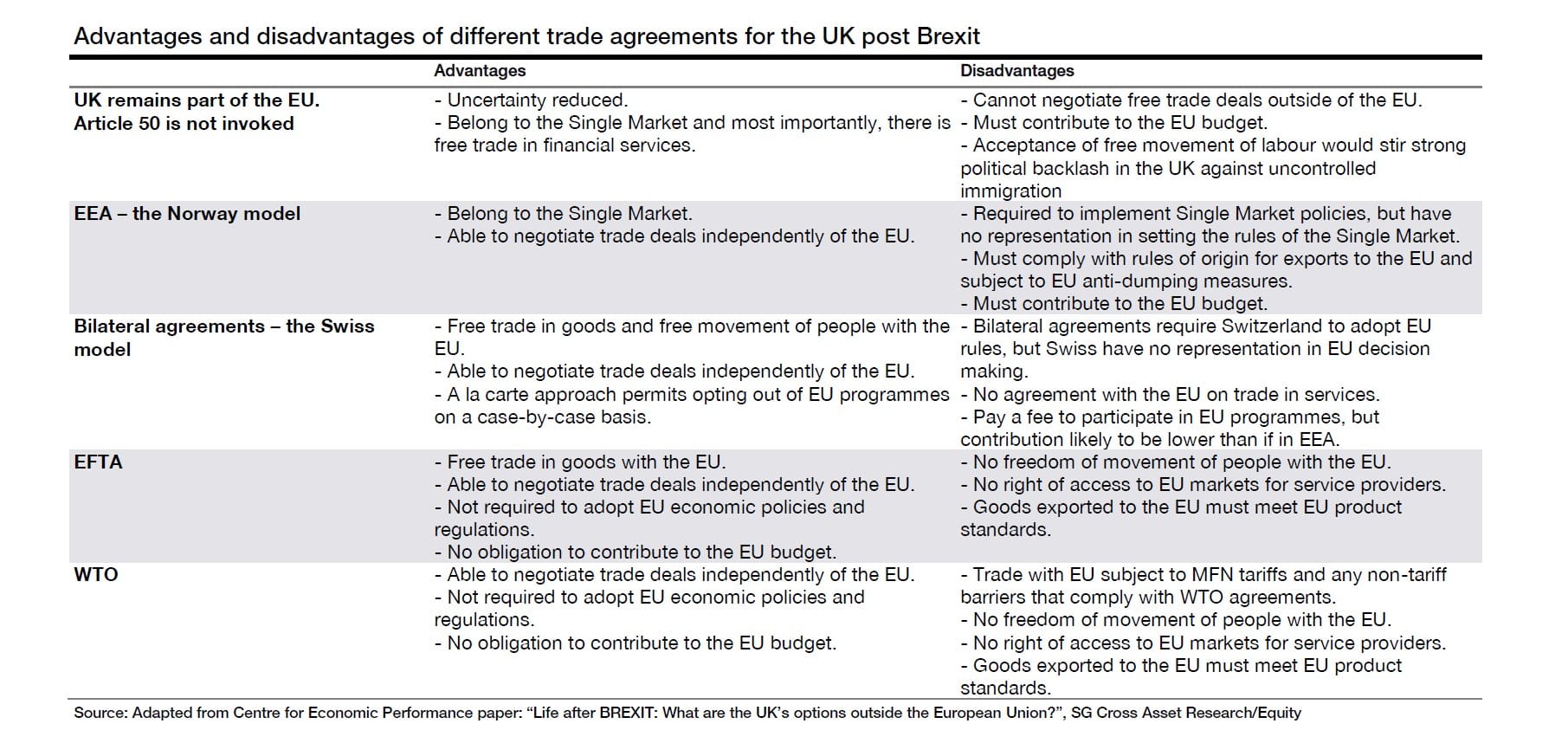

Interestingly and controversially we are starting to see speculative reports that the UK might not exit the EU after all and it is not hard to imagine the new government opening discussions to secure further concessions from Brussels. Remember that the UK leaving is not in the EU’s interest as it could start a domino effect. In order to pacify the electorate and the press these reforms would need to centre around immigration and welfare that Parliament could vote to accept as part of a new deal with the EU and in the process decide to stay in. Alternatively the UK could leave the EU, but join the EEA and allow the free movement of people as a price worth paying. Either option would allow life to continue largely as it is now. I think we will see more comments along these lines starting to emerge. However as I wrote last week, I do not fear leaving the EU, measures such as reducing corporation tax further, will go down well internationally, as would moves to create more flexible regulation for financial services, which would protect the City of London. There is much to be positive about if and when Article 50 is evoked. Markets do not like political uncertainty and any direction, regardless of which way it faces, will allow people to become more confident and to start investing again, from companies to individuals.

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.

The value of defined benefit pension scheme transfers in 2018 was an all time-high of £24 billion.

The value of defined benefit pension scheme transfers in 2018 was an all time-high of £24 billion. Finally, some good news for British expats in France who are clients of expat financial services providers; the French government has said that it will look to make its expat tax regime Europe’s most favourable – a move that is clearly designed to take advantage of uncertainty in London created by Britain’s decision to exit the EU.

Finally, some good news for British expats in France who are clients of expat financial services providers; the French government has said that it will look to make its expat tax regime Europe’s most favourable – a move that is clearly designed to take advantage of uncertainty in London created by Britain’s decision to exit the EU.