But Bitcoin is not the only cryptocurrency available, it is just the most widely used. Ethereum, Ripple and Litecoin and are some of the other digital currency offerings. And whereas critics of cryptocurrencies have Buffet onside, advocates can point to Bill Gates as a fan because he believes they represent the future.

Cryptohomes, which is behind the luxury villa sale, certainly believe in Bitcoin.

“Since our launch of CryptoHomes.io we have attracted a satisfying amount of attention from across the globe,” said a spokesperson for the firm.

“Both from potential buyers and from homeowners and real estate agencies interested in listing luxury properties on our site.”

Whatever the case, sales like this demonstrate that Bitcoin is increasingly viewed as a legitimate currency, although regulatory threats, dramatically fluctuating prices and general uncertainty make them something of a grey area as well as a real headache-inducing conundrum for expat financial advisers, not just in the Canary Islands but right across the world.

It is only recently (10 October) that the IMF warned rapid growth of cryptocurrencies could lead to “new vulnerabilities in the international financial system”. But the organisation was not only warning of volatility – Bitcoin’s price moved from $1,000 at the start of 2017 to almost $20,000 in December of the same year (it currently trades at around $6,500) – but also of the cybersecurity concerns.

“Cybersecurity breaches and cyber attacks on critical financial infrastructure represent an additional source of risk because they could undermine cross-border payment systems and disrupt the flow of goods and services,” warned the IMF in October’s World Economic Outlook report. “Continued rapid growth of crypto assets could create new vulnerabilities in the international financial system,”

Blacktower, expat financial advisers in the Canary Islands

Markets, currencies and economic systems evolve, change and are subject to volatility. Effective financial planning and wealth management is about putting plans in place to weather storms and make the most of opportunities. For some investors cryptocurrencies will form a legitimate part of this, for others, there may be too much risk involved.

Blacktower expat financial advisers in the Canary Islands can help you develop a strategy that aligns with your goals and investment personality. Talk to us today for more information.

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.

Portugal is hands down one of the best places for expats to retire to (certainly in the eyes of our Portugal team). And you just need to look at the statistics to realise how popular it is as a retirement destination.

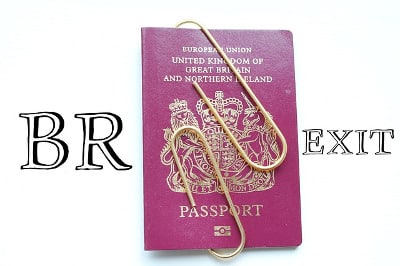

Portugal is hands down one of the best places for expats to retire to (certainly in the eyes of our Portugal team). And you just need to look at the statistics to realise how popular it is as a retirement destination. As it stands, EU citizens living in the UK are required to apply to the EU Settlement Scheme, which confirms that they are a settled resident of the UK. This has raised concern for many expats, and those living and working in the EU, about how they will be able to prove their identity and claim residency abroad if a no-deal Brexit goes ahead.

As it stands, EU citizens living in the UK are required to apply to the EU Settlement Scheme, which confirms that they are a settled resident of the UK. This has raised concern for many expats, and those living and working in the EU, about how they will be able to prove their identity and claim residency abroad if a no-deal Brexit goes ahead.