General Facts

The Riester-Rente was introduced in 2002.

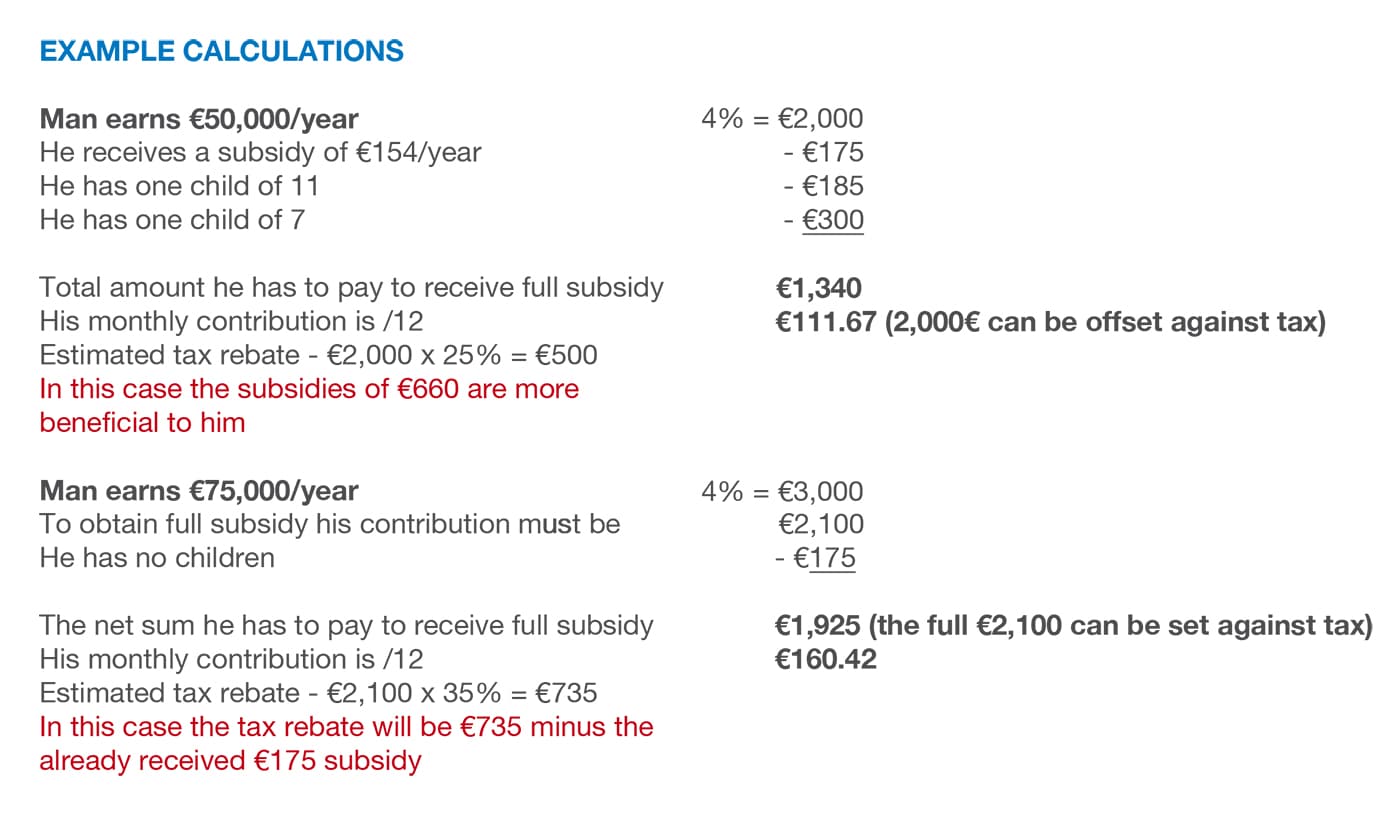

- Depending on what is most beneficial to the individual scenario, either the tax rebate or the subsidy will be used by the tax office in their yearly income tax calculations.

- Everybody paying into the state pension scheme is entitled to a Riester-Rente. People who are not entitled but are, however, married to or the register partner of someone who is, are also eligible for a Riester policy. They will receive the full subsidy but can only pay €120 per year in contributions.

- The government also subsidises the contributions. To obtain the full subsidy, 4% of the gross income has to be paid into the scheme. The subsidies obtained count towards the 4%. A maximum of €2,100 per year can be paid into the scheme and the full €2,100 (including the subsidy) can be offset against tax.

- The full subsidy is €175/year for adults and €300/year for children born after 2008. For children born before 2008 the subsidy is €185/year. The subsidy is always immediately used to lower the monthly premium.

- It is necessary to submit a tax return every year to receive the full benefits available.

- The monthly pension received is taxable at the personal tax rate for a pensioner. As a pensioner in Germany you have different tax regulations compared to when you are working.

- Most Riester-Rente products are funds-based. The products themselves offer a wide range of funds to choose from including managed portfolios. The advantage that insurance based products have is that you can switch funds up to 12 times a year free of charge and that there are no taxes to be paid on the profits until the pension draw phase.

- The contributions including the subsidies are guaranteed to 100%.

- Capital cannot be borrowed against a Riester-Rente.

- The minimum duration of the contract is 12 years.

- It is possible to have a 30% capitalisation of the balance at the start of the pension draw phase. The capitalisation affects taxes in the year it is drawn.

- It is possible at any time to withdraw all the capital if it is to finance a house that will be occupied by the Riester-Rente policy holder (Wohnriester).