Recently named Best Travel Destination in 2022 by Condė Nast travel magazine, Portugal continues to attract more interest from expats than any other European country.

Offering a wide variety of locations to move to that cater to a host of different lifestyles, it perhaps comes as no surprise that an increasing number of digital nomads and holidaymakers are looking to permanently move to Portugal from the UK. However, there’s no doubt that the moving process can be complicated, despite being worth it in the end.

As with any destination, inadequate financial planning when looking at how to move to Portugal from the UK can result in stress, fines, and costly consequences further down the line.

Laws and legislation regarding moving to Portugal after Brexit in particular can often differ from region to region, making it easy to be caught out by local variations in fiscal policies.

But the good news is that, here at Blacktower, we’re equipped with the understanding, knowledge, and regulatory footprint necessary to make the transfer of your personal financial arrangements for your move to Portugal as effortless as possible.

With our holistic range of financial planning services, our experienced advisers can help you with everything, from inheritance planning to Portuguese mortgage advice, allowing you to relax, knowing that your finances are in good hands.

With that in mind, here is what you need to know about how to move to Portugal from the UK.

Moving to Portugal from the UK

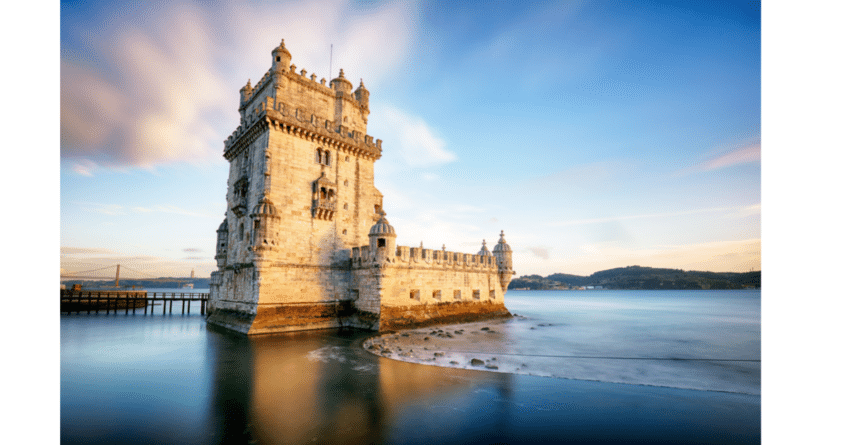

Many expats move to Portugal to make the most of its continual sunshine, delicious food, and breathtaking scenery. Backed up by Portugal’s relatively low cost of living when compared with other EU countries, it’s clear why moving to Portugal is such an attractive option for UK expats.

An estimated 480,000 expats live in Portugal, 60,000 of which are from the UK, with many wishing to take advantage of the country’s pension taxation rates. In fact, if you move here as a non-habitual resident, you won’t be taxed on your pension for your first 10 years in the country. Even after this period, you’ll still only be taxed at marginal rates.

But whether you simply wish to move to Portugal for work, want to bring up your family surrounded by stunning vistas, or just retire in the Portuguese countryside with some of the world’s best weather, it’s hard to find a better destination than this European country.

What are the benefits of living in Portugal?

The cost of living in Portugal may be low, and the tax rates favourable, but that’s not the only reason why expats continue to flock to this beautiful country. In fact, there are several benefits to moving to Spain’s neighbour.

300 days of sunshine a year

It’s claimed that Portugal enjoys 300 days of sunshine every single year, which is a stark contrast to the weather in the UK. The summers are hot, and the winters mild, with daily temperatures usually sitting between 10-16 degrees Celsius.

Although the coastal towns tend to get quite wet, expats in Portugal can enjoy an outdoor lifestyle all year round, whatever the weather.

Friendly locals

One of the most daunting parts of relocating to any new country is making new friends. Fortunately, the Portuguese are extremely friendly and hospitable and are often very happy to speak to expats. If you live next to a Portuguese family, expect to be invited over to spend long, lazy afternoons together sipping coffee.

Beautiful beaches

Boasting more than 850km of coastline, Portugal has a vast array of beautiful white beaches, which aren’t just confined to the Algarve. From long, sandy stretches and shallow waters, to hidden coves, dramatic cliffs, and choppy waters ideal for a wealth of water sports, Portugal’s beaches are as varied as the country itself.

Portuguese tax planning

Although there are many incentives to move to Portugal, it’s always worth bearing in mind the potential tax implications of taking such a step. Despite your move, there is still a range of different Portuguese taxes you could be liable to pay once you’ve moved, such as:

- Wealth Tax

- Income Tax

- Capital Gains Tax

- Property Tax

- A Solidarity Tax for high earners

Naturally, which taxes are applicable to you will depend on your financial circumstances and residency status.

While national deals, such as Double tax treaties, can alleviate some of your liability and help establish better efficiency in your taxation, it’s always a good idea to seek advice on your circumstance from local experts.

Portuguese residency

Much of your tax liability and other financial commitments in Portugal will depend on whether or not you’re classed as a resident. Therefore, it’s important that you establish whether or not you’re eligible for Portuguese tax residency as early on as possible to avoid paying over or under your tax liability.

Generally speaking, anyone living in Portugal will qualify as a Portuguese resident if they spend at least 183 days a year in Portugal over the course of the year, or if their primary residence is located in Portugal.

If applicable, Portuguese Income Tax rules may also include split-year residency; this means your tax liability is directly linked to your physical presence in Portugal, beginning on the first day of your stay and terminating on the day your stay ends.

Portuguese inheritance tax

Like both Spanish and UK inheritance tax, the process for dividing your estate up between your beneficiaries can be complex in Portugal. When passing on Portuguese property in particular, your beneficiaries are liable to pay stamp duty.

However, it may be possible to avoid this when gifting property to your children or other direct beneficiaries. This can be done in a range of ways but what’s best for one person may be disadvantageous to the goals and circumstances of another.

When it comes to Portuguese inheritance, we definitely recommend seeking out financial guidance to make the process simpler.

Portuguese investment tax

Last, but not least, in order to maximise your tax efficiency as an expat moving to Portugal, you may find it necessary to change how your investments are structured due to different investment types being taxed differently across the country.

Be sure to consider the tax efficiency of the following investments before you start your move:

- Equities

- Unit Trusts

- Open-Ended Investment Companies Investment Bonds (OEICs)

- Pension Income

- Rental Income

Can I move to Portugal without a visa?

Along with the potential financial complexities associated with moving to Portugal after Brexit, non-EU citizens need to apply for a Residency Visa or a Temporary Residence Permit in order to live in the country for a lengthy period of time.

The former visa allows applicants to move to Portugal before registering as a resident, giving them four months to register with the SEF and receive a Temporary Residence Permit.

Once approved, this visa allows applicants to stay in the country for two years, which can be extended for another year annually up to a limit of five years. After this visa expires, you can then apply for permanent residency.

Visa Types and NHR

There are three primary types of Residency Visas available in Portugal.

- Golden Visa (primarily for investors)

- D7 Visa (primarily for retirement or those living off investments abroad)

- D2 Visa (primarily for entrepreneurs)

The NHR scheme is designed to offer tax breaks to foreign residents. The scheme offers incredibly beneficial tax advantages to both first-time residents and those who have not been residents in Portugal for the past five tax years.

Moving abroad can be overwhelming, regardless of how familiar you are with your chosen destination. Thus, in order to secure a robust financial future for yourself and your family, financial planning is essential.

To get the most out of your savings and provide yourself with peace of mind, get in touch today with one of our experienced Blacktower advisers to start protecting your horizon in Portugal.

And if you want to find out more about international pensions, such as QROPs or SIPPs advice, or help with tax planning, our expert team can help. Alternatively, you can find out more about moving to Portugal with our free guides on moving abroad as an expat and the benefits of life assurance in Portugal in the relevant areas of our website.