Private Accident Insurance (Unfallversicherung) is designed to offer you financial protection if you do not recover your full abilities following an accident. Depending on the tariff you choose you will either receive a lump sum payment, a lifelong annuity paid in monthly instalments or a combination of both.

In Germany, at work or on the way to and from work (and school), you have limited state insurance cover. Private Personal Accident Insurance, however, offers you protection worldwide and around the clock. The concept is that the insured sum should cover all costs that occur through disability, for example physical assistance, temporary or permanent, alterations to your vehicle or your house, etc.

The loss of any income should be covered separately by Occupational Disability Insurance; this offers more protection than an accident insurance annuity, because it covers you in case of disability through illness also.

For this reason an accident annuity makes sense if, for health reasons, you cannot insure yourself for occupational disability.

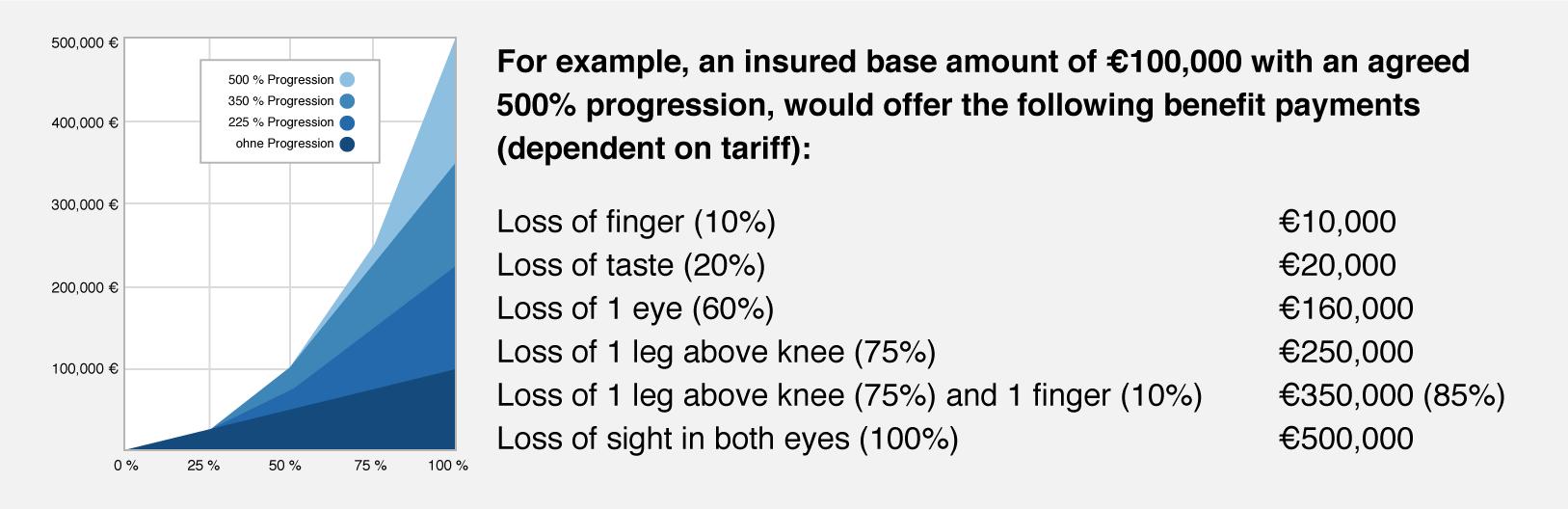

To determine how large the disability is and therefore how large your benefits will be, an extremities table is used. In this table each body part is given a percentage value of the overall reduction in your full mental and physical abilities. In this table a finger is worth, for example 10% of the insured sum, loss of sight in one eye is worth 60%, loss of sight in both eyes 100%, loss of a leg above the knee is worth 75% and taste and smell are each worth 20% (these values can vary slightly depending on the insurance company and tariff).

To work out what sums you should insure, you first need to think about how much money you need available to make your life as easy as possible should you become fully disabled through an accident. Once you have determined that amount, there are different options available to you.

How to configure your insurance cover regarding the benefits in case of an accident depends on which model suits you. You can then work out the base amount you need to insure to achieve your desired coverage.

Nearly all accidents have linear benefits (dark blue in diagram below) up to a degree of disability of 25%, after which you have the choice of either linear or progression.

Progression means the higher your degree of disability, the more payment you will receive in relation to your base amount. As of 26% the progression table takes effect leading up to the maximum agreed progression of the base amount, with a disability of 90% or over (see diagram – €100,000 base amount)

Finding the right personal accident insurance cover for you

Please answer the questions in the form below so that we can offer you the cover that best suits your needs and at the best price. Once you have returned the questionnaire you will be contacted to talk through the next steps.

{loadposition germanyForm}

If you would prefer to complete the form in writing, please download the PDF and send to the address supplied on the form.