Lets start with Pensions. If you are employed and have a pension scheme through your employer, you can pay into this without paying tax on the money paid into it. If you decide to pay more into your pension, a proportion of your annual bonus for example, ask the employer to treat this as ‘Salary Sacrifice’. This will save both you and the employer on their tax bill. Any salary that an employer pays to their employees will have a 13.8% National Insurance liability (paid for by the employer) but if money is paid into a pension scheme, they won’t pay this tax and most employers will increase the pension contributions to your pension by an agreed amount. Possibly passing the whole saving on to you. If you paid in £10,000 to your employers pension scheme, this would save the employer £1,380 in National Insurance.

For the self-employed, paying into their own pensions, tax relief on their contributions is an important part to understand. The 20% taxpayers will have their tax relief claimed for them by the pension provider. For the higher and additional rate tax payers (40 & 45%) the pension provider will automatically claim 20% of the tax back, the remaining tax will be claimed via Self Assessment annually. Basically for every £100 you put into you pension scheme, the pension company reclaims £25 from the HMRC for you automatically, the rest (depending on your tax rate) is claimed by you, so don’t forget to put your pension payments on your self assessment.

We need to now look further down the line at your retirement income. Income tax is due on the income from pensions in the same way earnings are now. So, there is no point in saving 45% tax today only to pay 45% tax in retirement. A non-working spouse can pay in £2,880 per year (which automatically gets grossed up to £3,600 due to the tax relief) which can be funded by the working spouse. This simple planning, over the years, can really increase the actual ‘In your pocket’ income derived from the pensions pots.

Everyone in retirement has personal income tax allowance (same as pre retirement) and then a 20% tax band; you should ensure that both you and your spouse use your allowances today and in retirement. £240 per month/£2,880 per year may sound like an insignificant number but if you started at 40 years old and paid in each year until 65, you would have paid in £72,000 but it would be worth £90,000 just from the tax relief. Compounded up with a 4% annual growth would yield a pension pot of £154,752. If this £154,752 was added to a higher or additional rate tax payer income the tax liability would negate the point of putting it in there in the first place. Sensible advice and long term planning with tax makes a huge difference to the income and lifestyle of your retirement.

by Leon Rhoades, Financial Planner UK

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.

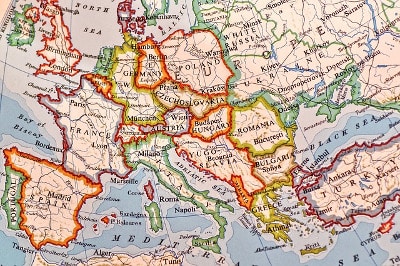

At the moment, no one can say with complete certainty what will happen in the near future regarding Brexit and pensions.

At the moment, no one can say with complete certainty what will happen in the near future regarding Brexit and pensions. Last year the Association of British Insurers (ABI) provoked something of a panic among British expats in Europe. Those who in some way rely on insurance products, such as annuities and life insurance, for the payment of income and expat pensions were understandably alarmed when Huw Evans of the ABI said that a no-deal Brexit could leave insurance contracts in legal limbo because of a risk that payments could not be fulfilled for contracts written pre-brexit. (

Last year the Association of British Insurers (ABI) provoked something of a panic among British expats in Europe. Those who in some way rely on insurance products, such as annuities and life insurance, for the payment of income and expat pensions were understandably alarmed when Huw Evans of the ABI said that a no-deal Brexit could leave insurance contracts in legal limbo because of a risk that payments could not be fulfilled for contracts written pre-brexit. (