Research reveals that Portugal is quickly becoming the favourite location for Americans moving overseas to Europe, outranking the previously preferred destinations of Spain and France for the first time.

With its beautiful and varied landscape, fantastic food and welcoming locals, Portugal has always been a popular location for expats, both working and retired. However, in recent years, this popularity has surged dramatically, particularly with Americans looking to find a new home in Europe.

Research by mydolcecasa.com assessing data surrounding ‘moving to’ google searches revealed that while France and Spain were the go-to destinations for American expats over the past decade or so, Portugal has surpassed both in terms of interest from the US population. It is not only these previously favoured locations that have been overshadowed by the ‘rising star’ of Portugal, but also other popular destinations such as Germany, Switzerland and Italy.

The research into search trends concerning the phrase ‘real estate in’ suggests that a considerable proportion of these Americans looking to emigrate to Portugal are also considering committing to the purchase of property there too, in turn implying that they are intending to stay in the country long term, or even permanently. This is probably due in part to the fact that property is significantly cheaper in Portugal than the US, with the median price of a Portuguese house in 2022 working out at $138 per square foot, well below the $202 US equivalent cost.

If you are thinking about purchasing property abroad, you can read our blog on Things to Consider when Buying a Property Abroad.

If you would like to speak with one of our experienced financial advisers regarding financial services in Portugal, you can click the link below to arrange a complimentary consultation.

This communication is for informational purposes only, based on our understanding of current legislation and practices which is subject to change and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice form a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.

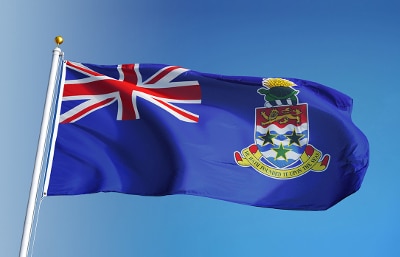

The Cayman Islands has a new governor following the announcement that Martyn Roper OBE, a career diplomat and corporate leadership veteran, has been appointed to the role. He takes over from Anwar Choudhury, who had recently faced a number of complaints regarding his conduct.

The Cayman Islands has a new governor following the announcement that Martyn Roper OBE, a career diplomat and corporate leadership veteran, has been appointed to the role. He takes over from Anwar Choudhury, who had recently faced a number of complaints regarding his conduct. In the UK, the first week of October is National Work-Life Week, which encourages employers and employees to look at how they can improve their well-being at work and strike a healthier balance between family life and their job. The aim is to help reduce stress among a company’s workforce by offering more flexible ways of working, allowing workers to have time for other priorities in their life.

In the UK, the first week of October is National Work-Life Week, which encourages employers and employees to look at how they can improve their well-being at work and strike a healthier balance between family life and their job. The aim is to help reduce stress among a company’s workforce by offering more flexible ways of working, allowing workers to have time for other priorities in their life.