If a Bank, especially in Spain is offering more than this please be wary, the product they are offering will most probably be a structured product, though they often looked like a normal savings deal, these are based they were based on stock market performance. They usually offer a variety of these ranging from no risk, through low, medium to high risk.

With the no risk ones the return you get will depended on either the FTSE or Euro STOXX 50 hitting a number of targets over a set time — usually five years. They are sold as ‘guaranteed’ bonds, because if the stock market failed to do well, you are always going to get back the original money you put in. But in most cases the return on these has been minimal and you would have been better putting your money in a low risk tax efficient investment product.

Share Isa´s

Not only are these not tax efficient if you are a Spanish tax resident, with most of the older style share ISA´s if you wanted to invest your Isa savings, you generally had to go directly to the investment management group running the fund.

This meant upfront charges of as much as 5 per cent and annual running fees of 1.75 per cent or more. For the first £1,000 invested, that’s £67.50 taken in one swipe.

If you wanted to have investments in two different funds, you had to have accounts with two different companies. This made it a mammoth task to keep on top of your investments, as they were all in different places. And if your fund stopped performing, it could take months to move to a different provider.

There is around £75 billion lurking in these old-fashioned fund manager Isa accounts, according to industry calculations.

But you don’t need to leave your money languishing in this way. It should be relatively straightforward to move your money out of one of these outdated Isa accounts and into a tax efficient investment.

0

0

1

7

43

Social INK

1

1

49

14.0

Normal

0

false

false

false

EN-US

JA

X-NONE

/* Style Definitions */

table.MsoNormalTable

{mso-style-name:”Table Normal”;

mso-tstyle-rowband-size:0;

mso-tstyle-colband-size:0;

mso-style-noshow:yes;

mso-style-priority:99;

mso-style-parent:””;

mso-padding-alt:0cm 5.4pt 0cm 5.4pt;

mso-para-margin-top:0cm;

mso-para-margin-right:0cm;

mso-para-margin-bottom:10.0pt;

mso-para-margin-left:0cm;

line-height:115%;

mso-pagination:widow-orphan;

font-size:11.0pt;

font-family:Calibri;

mso-ascii-font-family:Calibri;

mso-ascii-theme-font:minor-latin;

mso-hansi-font-family:Calibri;

mso-hansi-theme-font:minor-latin;}

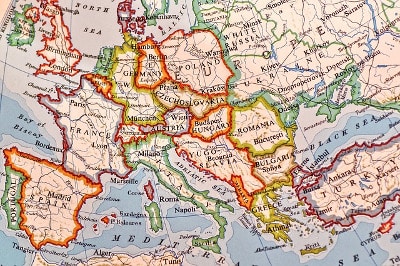

by Christina Brady, Regional Manager Costa Blanca

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.

Last year the Association of British Insurers (ABI) provoked something of a panic among British expats in Europe. Those who in some way rely on insurance products, such as annuities and life insurance, for the payment of income and expat pensions were understandably alarmed when Huw Evans of the ABI said that a no-deal Brexit could leave insurance contracts in legal limbo because of a risk that payments could not be fulfilled for contracts written pre-brexit. (

Last year the Association of British Insurers (ABI) provoked something of a panic among British expats in Europe. Those who in some way rely on insurance products, such as annuities and life insurance, for the payment of income and expat pensions were understandably alarmed when Huw Evans of the ABI said that a no-deal Brexit could leave insurance contracts in legal limbo because of a risk that payments could not be fulfilled for contracts written pre-brexit. (