With the recent turbulence in UK politics resulting in budget reviews and u-turns, it has been a time of uncertainty when it comes to government policies, as nothing seems set in stone. These constant developments have been concerning for many as the cost of living crisis puts pressure on much of the population to plan ahead and save what they can, where they can. As we enter 2023, many are looking to the future and considering how best to prepare financially for the months – and years – ahead. Pensions, as an intrinsic part of long-term wealth management, are of course no exception to this, but with pension policy changes expected in the new year, you might need to revisit your current retirement plan.

Additional Tax Relief for High Earners

One of the primary changes outlined in the Autumn budget last year is that the Income Tax additional rate threshold will be lowered from £150,000 to £125,140, meaning that anyone earning above the latter will now be included in the 45% income tax band as opposed to 40%. This in turn will incentivise people to contribute to their pensions, as income tax is refunded on contributions up to certain limits (£40,000 annually and £1,073,100 during your lifetime).

However, the security of tax-free contributions as we know it might also be at risk, as there have been suggestions that the government could reduce the annual allowance, particularly for higher earners, in order to generate more tax income for the treasury.

State Pensions

Whilst a lot of the government initiatives might appear to be rather doom and gloom, there is at least some good news when it comes to policy changes concerning state pensions, which are set to increase by 10.1% from April 2023 as a result of the reinstatement of the ‘triple lock’ guarantee. This means that if you qualify for a full state pension, you will receive £203.85 per week as opposed to £185.15.

A review of the state pension age should also be announced in the coming months which is currently set to increase to 67 by 2028.

If you would like to arrange a complimentary consultation with one of our experienced advisers regarding your pension or retirement plan, get in touch by clicking the link below.

Talk to us today

To understand more about how our How could your UK pension be changing in 2023? Service will benefit you, Contact Us Today

"*" indicates required fields

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice form a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.

UK pensions consultancy, XPS Pensions Group (XPS), has reported a concerning rise in “red flag” pension transfer scam activity. It says that the number of red flag incidents rose from 13% in June 2018 to 34% in June 2019 and calculated the total value of the pensions savings placed at risk during the 12-month period at £73,000,000*.

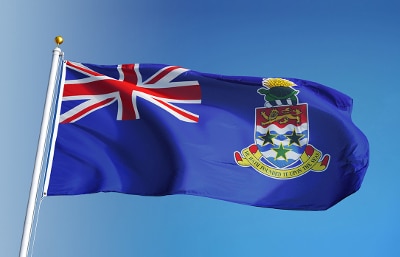

UK pensions consultancy, XPS Pensions Group (XPS), has reported a concerning rise in “red flag” pension transfer scam activity. It says that the number of red flag incidents rose from 13% in June 2018 to 34% in June 2019 and calculated the total value of the pensions savings placed at risk during the 12-month period at £73,000,000*. The Cayman Islands has a new governor following the announcement that Martyn Roper OBE, a career diplomat and corporate leadership veteran, has been appointed to the role. He takes over from Anwar Choudhury, who had recently faced a number of complaints regarding his conduct.

The Cayman Islands has a new governor following the announcement that Martyn Roper OBE, a career diplomat and corporate leadership veteran, has been appointed to the role. He takes over from Anwar Choudhury, who had recently faced a number of complaints regarding his conduct.