Further good news is that Rolls Royce has won a $2.7Bn order from budget carrier Norwegian Air for a package of new Trent 1000 engines and service support for 19 new 787 Dreamliner aircraft. This is just as well because it looks like the order book for Rolls Royce limousines to oil Sheiks will be slowing down. What a shame.

This week, Google, which is now part of our day-to-day language and activity, showed an impressive share rise by 6%. This pushed its market capitalisation above Apple making it the most valuable Company in our solar system, and possibly beyond.

Lastly, Mark Carney, Governor of the Bank of England has said UK interest rates will remain low until well into next year, and I know many of you will be unhappy about that. Would you like to be happy again? Call us as we have several solutions and will find one that suits you and your circumstances best.

‘Til next time, I’m off for a drive with the family, because I can and cheaply.

Time for action? Call us.

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.

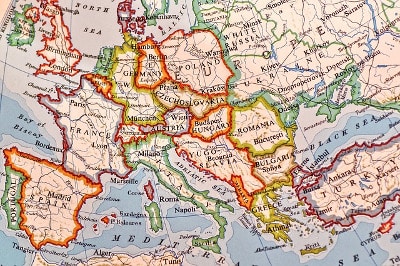

Last year the Association of British Insurers (ABI) provoked something of a panic among British expats in Europe. Those who in some way rely on insurance products, such as annuities and life insurance, for the payment of income and expat pensions were understandably alarmed when Huw Evans of the ABI said that a no-deal Brexit could leave insurance contracts in legal limbo because of a risk that payments could not be fulfilled for contracts written pre-brexit. (

Last year the Association of British Insurers (ABI) provoked something of a panic among British expats in Europe. Those who in some way rely on insurance products, such as annuities and life insurance, for the payment of income and expat pensions were understandably alarmed when Huw Evans of the ABI said that a no-deal Brexit could leave insurance contracts in legal limbo because of a risk that payments could not be fulfilled for contracts written pre-brexit. (