A question of clarity

The Financial Conduct Authority (FCA) recently expressed concern that even some regulated advisers may not always be clear about whether they are offering information or advice.

On June 25, Andrew Bailey, the Financial Conduct Authority’s chief executive, told the Treasury select committee that following the recent suspension of the Woodford Equity Income fund the organisation was looking at the possibility of expanding its scope to examine situations in which advisers are not transparent about whether they are providing information or advice.

Furthermore, Mr Bailey expressed his belief that regulatory enforcement should look to transition from a rules-based system to one based on principles, as this would move both the FCA and its accredited firms away from a “tick-box” culture.*

Information or advice

Different regulator rules apply to firms depending on whether they are licensed to give advice or information. However, some firms are effectively burrowing their way through regulatory loopholes by appearing to give advice when they are in fact only licensed to give information.

The Personal Finance Society’s Keith Richards believes that the issue needs addressing. “It cannot be right that regulated professionals who do perform to high professional standards should be tainted by the activities of firms that do not behave in an ethical way, and who, in addition, do not contribute to the cost of compensation and regulatory supervision,” he said.*

Blacktower Financial Management – a firm you can trust

When you are a client of Blacktower Financial Management you can have every confidence that we are putting your interests first.

Our extensive regulation and licenses mean that we have the flexibility to act for you in many capacities. For example, under the Insurance Distribution Directive we have permission to recommend ‘Wrappers’ and provide Investment Advice on the underlying Portfolios.

Under the Markets in Financial Instruments Directive (MIFID) we are authorised to provide Investment Advice on Collective Investments.

Under the Product Governance Committee we are obliged to conduct ongoing due diligence on all the providers we work with to ensure that they remain suitable to our target market and all the ‘Retail Solutions’ we are able to provide.

When assisting clients looking to transfer from a Defined Benefits Occupational Pension Scheme (or any UK based pension which has Guaranteed Benefits) we only ever introduce clients to a UK FCA-regulated Pension Transfer Specialist who meets the (PFS Accredited) UK FCA Pension Transfer Specialist Gold Standard.

Furthermore, when giving advice relating to Malta Based Pensions/ROPS, we have MIFID accreditation so are fully regulated to act in this regard.

Whether you would like to consider the possibility of an expat retirement transfer or are looking for some other form of expat financial advice, contact your local Blacktower Financial Management office today.

* https://www.ftadviser.com/investments/2019/06/26/pfs-calls-for-advice-loopholes-to-be-fixed/?utm_campaign=FTAdviser+news&utm_source=emailCampaign&utm_medium=email&utm_content= Accessed 28-06-19

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.

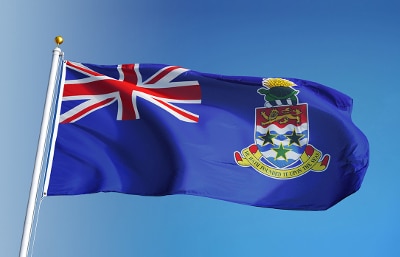

The Cayman Islands has a new governor following the announcement that Martyn Roper OBE, a career diplomat and corporate leadership veteran, has been appointed to the role. He takes over from Anwar Choudhury, who had recently faced a number of complaints regarding his conduct.

The Cayman Islands has a new governor following the announcement that Martyn Roper OBE, a career diplomat and corporate leadership veteran, has been appointed to the role. He takes over from Anwar Choudhury, who had recently faced a number of complaints regarding his conduct. ng home from the pub on a Saturday night (and I’m Glaswegian so I’m allowed to joke about things like that); I’m talking about 2016 and what faces each and every one of us this year – uncertainty. In fact, it could almost be classed as uncertain uncertainty. The key issue for British expats is obviously the UK referendum on 23rd June when the vote will be taken as to whether or not the UK will stay in the European Union.

ng home from the pub on a Saturday night (and I’m Glaswegian so I’m allowed to joke about things like that); I’m talking about 2016 and what faces each and every one of us this year – uncertainty. In fact, it could almost be classed as uncertain uncertainty. The key issue for British expats is obviously the UK referendum on 23rd June when the vote will be taken as to whether or not the UK will stay in the European Union.