Founded in London in 1986, the Blacktower Financial Management Group provides wealth management consulting and a tailored service for individual and corporate clients. In this interview, António Rosa, Associate Director, delineates the role of Blacktower inside and outside Portugal.

Introduce Blacktower Financial Management Group to our readers.

The Blacktower Group, as we know it today, started in 1986 in London as a small financial services company.

In 1999, the Blacktower group’s first international office was founded in Quinta do Lago, in Portugal, where the history of Blacktower Group first began.

The founder, John Westwood, loved the Algarve, finding it reminiscent of Surrey in England which is located just outside of London. He believed that Quinta do Lago had a similar combination of business-oriented characteristics and an international population who enjoyed golf, the sound of the sea and the quality of life.

The company’s focus at the time was the same as it is today: prioritizing the individual over the corporate.

In addition to England and Portugal, we also have offices throughout Europe, notably in Spain, France, Holland, Sweden and Cyprus.

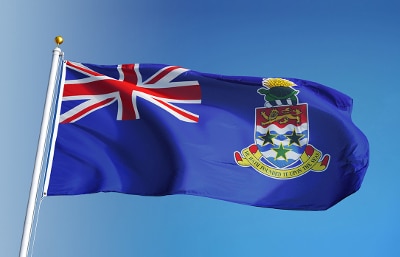

After our expansion in Europe, we started operations in the USA and the Cayman Islands. We have our US offices in Miami and New York and our Cayman Islands operation offers Discretionary Fund Management, a discretionary management service where we can deliver highly personalised, tailored made investment portfolios based upon the client’s circumstances and objectives.

Some of our clients are retired individuals who want to maintain their financial situation, meaning their risk tolerance is often much lower than other groups. We work with investment firms in London and Europe who understand that positioning and invest accordingly. Most clients make investments in a medium to short-term strategy.

What are the main investment bets in Portugal?

We present solutions tailored to the clients personal circumstances and dependent on how long the individual intends to stay in Portugal. We are careful with the proposals we present and offer international solutions, such as insurance policies and investments with reputable, well established financial institutions. We also work with real estate companies that invest in Portugal

What other areas can be explored in terms of investment in Portugal?

We are a small family in the Lisbon office; we have three financial advisors in Lisbon and six in Quinta do Lago. We are here to ensure a quiet and safe visit to Portugal for foreigners arriving here. We want to help you decide where you should invest your pensions and assets.

We also aim to, within the area of insurers, fulfill all the wishes of our customers and their heirs when it comes to inheritance planning.

With the UK leaving the European Union, will there be an investment opportunity with Golden Visa?

As a result of Brexit, everything has changed, including the Golden Visa. It is not enough to make a large investment in real estate anymore, it now has more to do with financial investment, for example, half a million euros in financial funds. We participate in getting our client access to these funds and directing that money to the right investment in order to obtain the Golden Visa.

We have clients who have already invested in Santo Estêvão, Penafiel and Vila Nova de Cerveira, whereas previously, all properties were acquired in large major cities with Lisbon Porto and Algarve area.

What is your position? How do you like to be recognized in the capital market?

We prefer to be seen as local financial advisers with a good history, but since we have offices in three continents, we try to help clients from a Portuguese perspective, as well as about other jurisdictions – we are small in Portugal, but we have a global perspective.

In conclusion, we are an organization with 250 employees, and we currently manage two billion assets. We have credibility both inside and outside of Portugal.

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.

While many expats are overseas because they’ve retired, a significant number of Britons move away for work.

While many expats are overseas because they’ve retired, a significant number of Britons move away for work. The Cayman Islands has a new governor following the announcement that Martyn Roper OBE, a career diplomat and corporate leadership veteran, has been appointed to the role. He takes over from Anwar Choudhury, who had recently faced a number of complaints regarding his conduct.

The Cayman Islands has a new governor following the announcement that Martyn Roper OBE, a career diplomat and corporate leadership veteran, has been appointed to the role. He takes over from Anwar Choudhury, who had recently faced a number of complaints regarding his conduct.