Picturesque and stunning in equal measure, moving to Switzerland is the ideal scenario for many of those looking to leave their home country. From the gorgeous Lake Geneva to the historically fetching architecture of Zurich and Basel, there’s plenty to admire about Switzerland; and that’s even before touching on its skiing resorts and snow-capped peaks.

But while Switzerland is a beautiful place to call home, its housing market can be troublesome for first-time buyers and non-residents alike. Not only is buying property in Switzerland a slow process, but there are also plenty of restrictions you’ll likely have to navigate to get your dream home.

Combine this with the dramatically varying prices and interest rates between the different Swiss cantons and you have a property market that is intensely competitive in the cities but not so much in its more rural areas.

With that being said, if your heart is truly set on moving to Switzerland, then this guide is going to be invaluable in helping you to navigate the often frustrating process of buying a Swiss home.

We’ve broken down all the steps you’ll need to take in the Swiss property buying process, as well as pitfalls to avoid, to ensure that you get your ideal alpine home and can move in as soon as possible.

How do expats buy a property in Switzerland?

With well over 40% of those living in Switzerland being of a foreign nationality, it should come as no surprise that the Swiss are more than welcoming towards foreigners looking to buy a house in Switzerland. However, there are limits you need to be aware of.

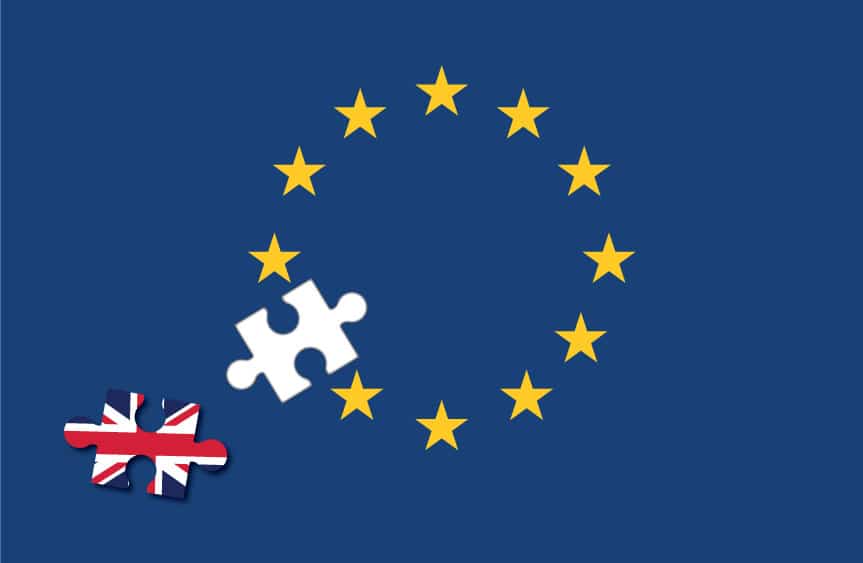

First things first, if you’re not an EU national, or EFTA national with a Swiss residency permit, then you’ll only be able to buy property in specific areas. This is due to what’s known as the Lex Koller, a set of laws designed to prevent too many properties from being sold to foreigners.

Under the Lex Koller, those without a residency permit may only buy property in designated holiday zones that are no bigger than 200sqm in size per individual living there. There are exceptions to the rule in certain cantons, but these are few and far between.

Fortunately, all these strict restrictions can be voided with a residency permit. These are simple enough to get hold of and are a key first step when buying Swiss property. There are two types of residency permits you can apply for:

- A B permit – a B permit allows you to buy a single property in Switzerland to act as your primary residence.

- A C permit – a C permit gives you the same property buying rights as a Swiss citizen.

The best way to get your residency permit sorted quickly is to discuss it with your chosen notary or an international mortgage broker, like the ones we work with here at Blacktower.

The current state of the Swiss property market

At the time of writing, the Swiss property market is in an interesting place. Swiss homeownership is some of the lowest in Europe, with less than 40% of people actually owning their homes.

The majority of homeowners tend to be found in rural communities and villages, and while this can offer some spectacular views and quaint lifestyles, it’s certainly not for everyone.

Unfortunately, as a result of this, competition for properties in the major Swiss cities is fierce. A large population growth in recent years has put a strain on the housing market, and when combined with rising prices and a healthy dose of Swiss bureaucracy, the process needed to complete a purchase can be slow and laborious.

With that being said, you’ll still be able to find a range of property types in Switzerland, from large, detached houses to spacious apartments. You’re also more likely to find green homes that are environmentally friendly and energy efficient thanks to Swiss efforts to make new builds more energy economical.

In short, buying a house in Switzerland can be tough, and it’s difficult to give exact prices on property types and locations as these figures will vary depending on the Swiss canton you choose. But buying is certainly not off the table, you just have to be willing to commit to a lengthier and more competitive process than in other countries.

The first stages of buying property in Switzerland

Although the later stages of buying Swiss property can be lengthy, to begin with, the initial steps to buying a home in Switzerland differ little from most other popular expat-friendly countries.

It will likely come as no surprise to those seeking to buy a house in Switzerland that the majority of Swiss properties are sold online via estate agents or through various property portals.

You may be able to find some through local papers, but as an expat, looking online is your best place to start; though if you have local knowledge, you may very well be able to find local agents who have off-market properties available to view.

The main expat-friendly property portals that are recommended include:

- Homegate

- ImmoStreet

- ImmoScout24

- UMS Temporary Housing

As for country-wide Swiss estate agents, popular ones include:

- Privera

- Wincases

- Moser Vernet & CIE

Lastly, if want to ensure you’re working with a qualified estate agent, you can look at the Swiss Real Estate Association’s website for a list of registered estate agents, as well as the local listings for each canton.

Once you’ve decided on how you intend to find your properties of choice, and you’ve found several that you like, the next step is to organise a visit to Switzerland for viewings. It is always recommended to view properties in person to ascertain if they’re right for you.

It’s also recommended that you begin the mortgage application process in tandem with your house hunting. While you can begin the preliminary aspects of your mortgage application online, you will be required to visit in person at some point, so it’s best to do your viewings and mortgage meeting simultaneously.

Generally speaking, you want to begin the mortgage application process as soon as possible as you won’t be able to make an offer on your chosen property before your mortgage is sorted. You can read more on this topic in our guide on how to get a mortgage in Switzerland as an expat[MF1] .

Finally, when you do find a property you like, you should make a bid as soon as possible in order to secure it off the market, at which point you can get the property valued by your chosen bank to ensure you’re paying a fair price for it.

What costs are associated with buying a house in Switzerland?

With property costs in Switzerland being so high, you could be forgiven for expecting the other costs associated with buying property in Switzerland to be as equally pricey. In fact, it is quite the opposite.

The transaction costs around buying Swiss property are surprisingly low and can often be a nice surprise after the relatively costly expenditure required to purchase your chosen property. The number of additional costs is also kept to a minimum, usually only including the following:

- Real estate transfer tax costs – 0.2-3.3% of the total property value.

- Registration fees – 0.15% of the total property value.

- Notary fees – 0.1% of the total property value.

On top of this, you may be required to pay a yearly maintenance fee of 1% of your new home’s total property value to help maintain communal areas in flats or commons areas near to your home.

In total, your additional transaction costs are likely to cost no more than 0.25-3.5% of your total property value, though it is highly recommended that you budget for 5% of the purchase price as a safety net.

The last steps for buying a property in Switzerland

Now that you have your ideal property ready for purchase, it’s time to deal with all the legal minutia that comes with it. For those looking to buy a property in Switzerland, you may be pleased to hear that the majority of this is handled by your chosen notary.

A notary is required by Swiss law to oversee all property transactions, working as a neutral party between buyer and seller, so you can be sure that they have the best interests of both parties at heart.

Upon having your offer accepted, the first step will be to hand over the required deposit to your notary, who will keep hold of it until the buying process is complete. You must then inform your mortgage provider of this so you can complete the remaining mortgage paperwork, which will be transferred upon informing your notary of its completion.

From here, your notary will handle the entire property transfer process, drawing up the required contract, holding onto the necessary funds, registering the change of ownership, and ensuring the entire process adheres to all legal formalities and requirements.

One important thing to bear in mind is that you should have a translator with you during this process. Under Swiss law, all people involved in signing a contract must be able to understand its contents before agreeing to it.

And once said contract is signed, that’s it! Your notary will finalise all last-minute steps before handing over the keys to your new home so you can move in immediately.

Other things to consider when looking to buy a house in Switzerland

While we’ve covered all the major steps required for buying Swiss property, there are still a few things you may want to bear in mind before committing to buying any property.

First, as with buying any new home, it’s always best to enlist the services of a professional property surveyor to go over a potential home before buying. This will help identify any issues that may cause trouble in the future.

Professional property surveys are uncommon in Switzerland, however, the seller is under no legal obligation to notify you of any property issues, so it’s best to have one done just to be on the safe side.

Secondly, you will need building insurance before you can finish the purchase of your new property. This insurance is for protection against natural disasters and property damage, which, while rare, is necessary under Swiss law.

Finally, it’s always best to get a back-out clause inserted into any preliminary purchase agreement to give yourself a back-out option should things fall through. This will allow you to recover your deposit should the worst happen.

With those final points, you should hopefully now have a much better understanding of what is required when looking to buy a property in Switzerland. The purchase of any new home can be a complex process, but with the right advice and knowledge, you should have no issues finding your ideal alpine property.

But it’s not just moving to Switzerland that our expert team at Blacktower can assist you with. We work with countless expats looking to move to countries around the world, so, if you’re interested in moving abroad in Europe or around the world, why not browse our about us page to see where we operate?

And on top of this, you can also find plenty more information on living abroad in our free guides and on our insights page, or you can contact the Blacktower team today to see how we can help you.

This communication is for informational purposes only, based on our understanding of current legislation and practices which is subject to change and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.

[MF1]Link to Swiss mortgage guide when live.

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.

Despite the protestations of expats in the Netherlands, expat financial advisers and business leaders, the Dutch cabinet recently announced that it would proceed with plans to reduce the favourable 30% expat ruling from eight to five years.

Despite the protestations of expats in the Netherlands, expat financial advisers and business leaders, the Dutch cabinet recently announced that it would proceed with plans to reduce the favourable 30% expat ruling from eight to five years. still pondering over the question!

still pondering over the question!