Here is how much you should have already saved for retirement

Millions of employees work tirelessly for decades in the expectation of a comfortable retirement in the future. But for many Britons retirement is an event to be feared due to lack of savings and pension.

To help you understand how much is needed for a comfortable retirement we have revealed how much you need to save, and top tips on how to save efficiently.

If you plan on living out your retirement years without worrying about finances, retirement saving is a must.

But do you know how much you need to have saved in order to live comfortably in retirement?

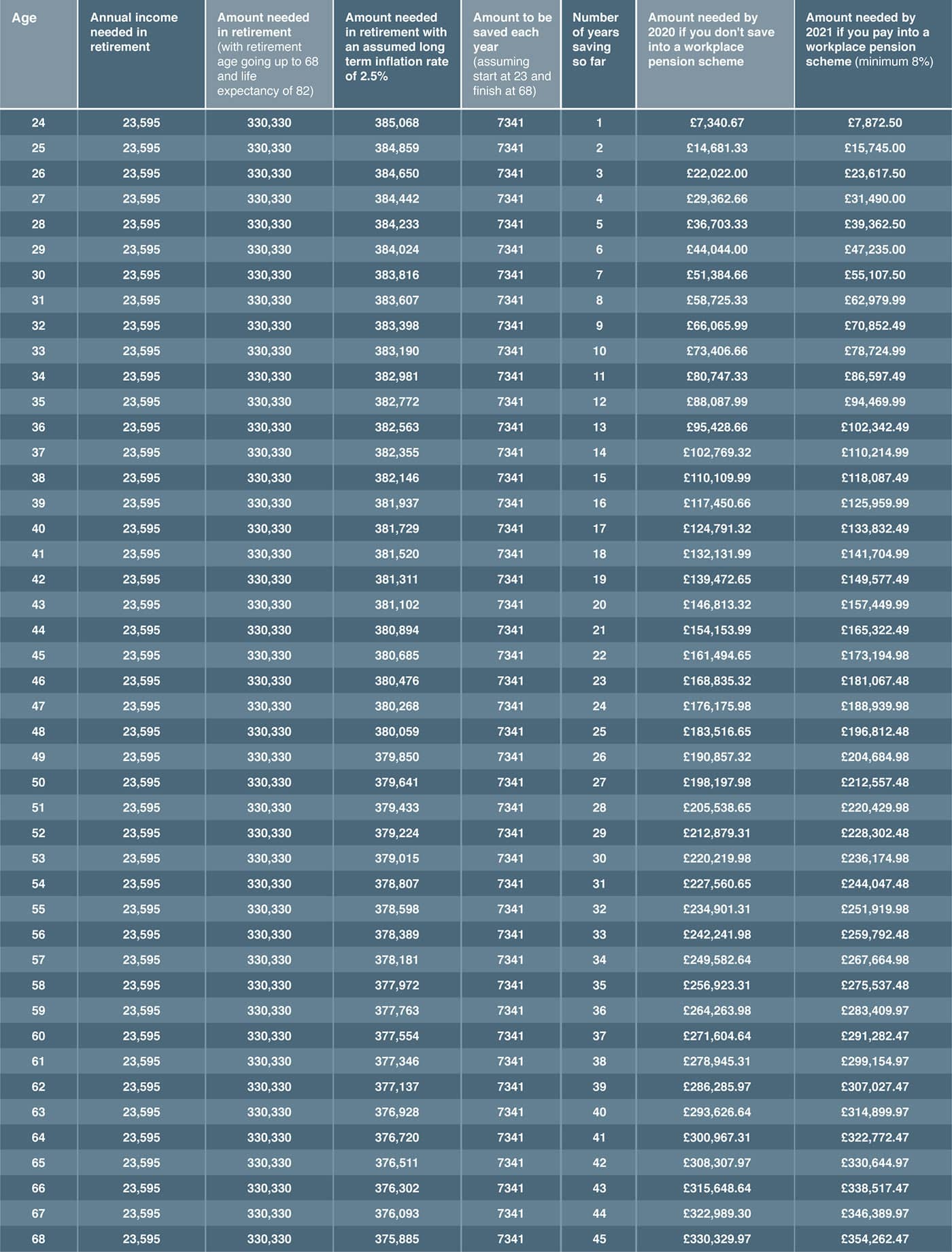

Generation X needs to save £330,330 by the time they retire to have an income of £23,595 a year. Nationwide, this amount would be enough money to live comfortably.

Check your age against the amount you need to have currently saved to find out if you’re on track.

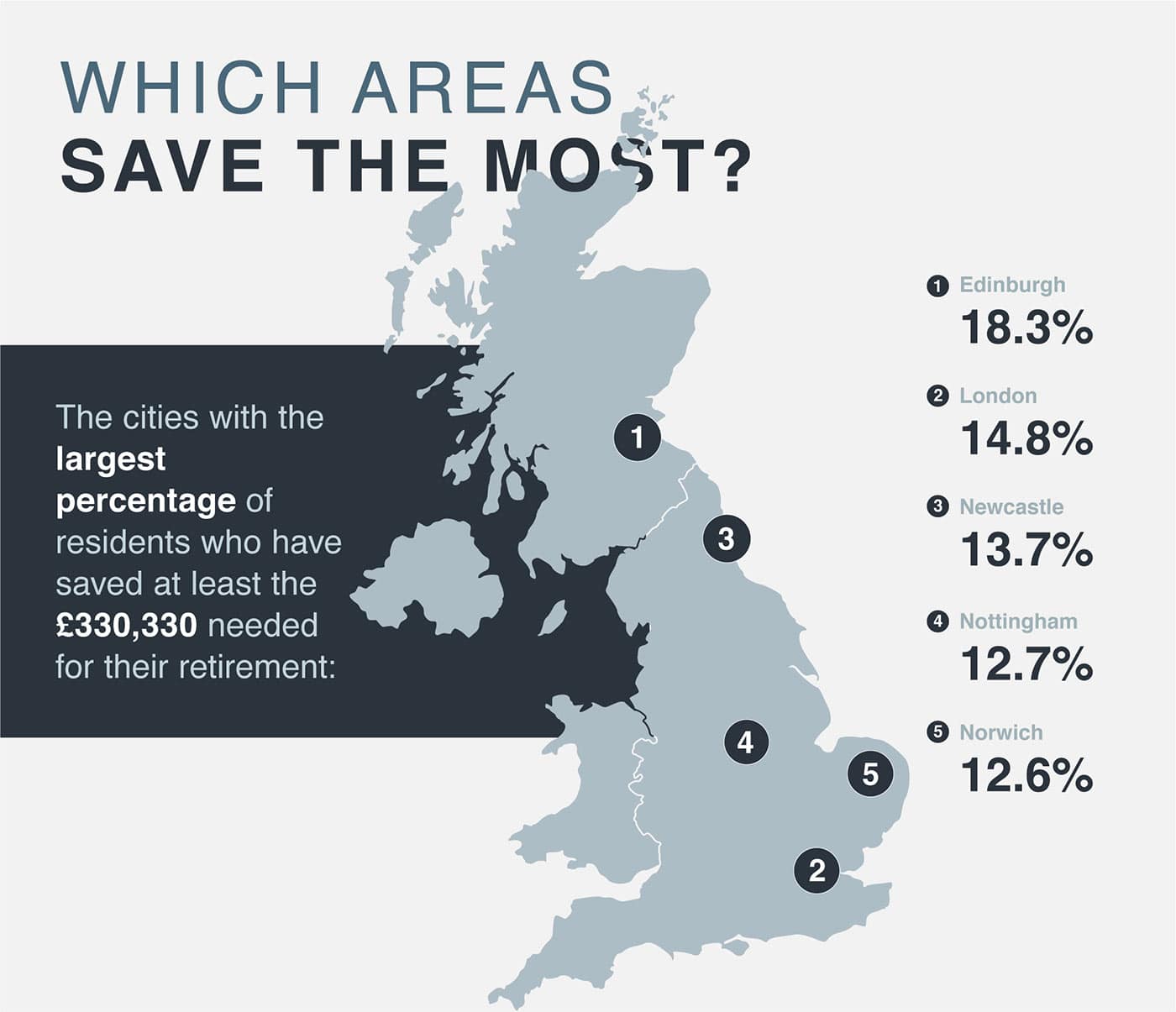

Which areas save the most?

The cities with the largest percentage of residents who have saved at least the £330,330 needed for their retirement:

- Edinburgh 18.3%

- London 14.8%

- Newcastle 13.7%

- Nottingham 12.7%

- Norwich 12.6%

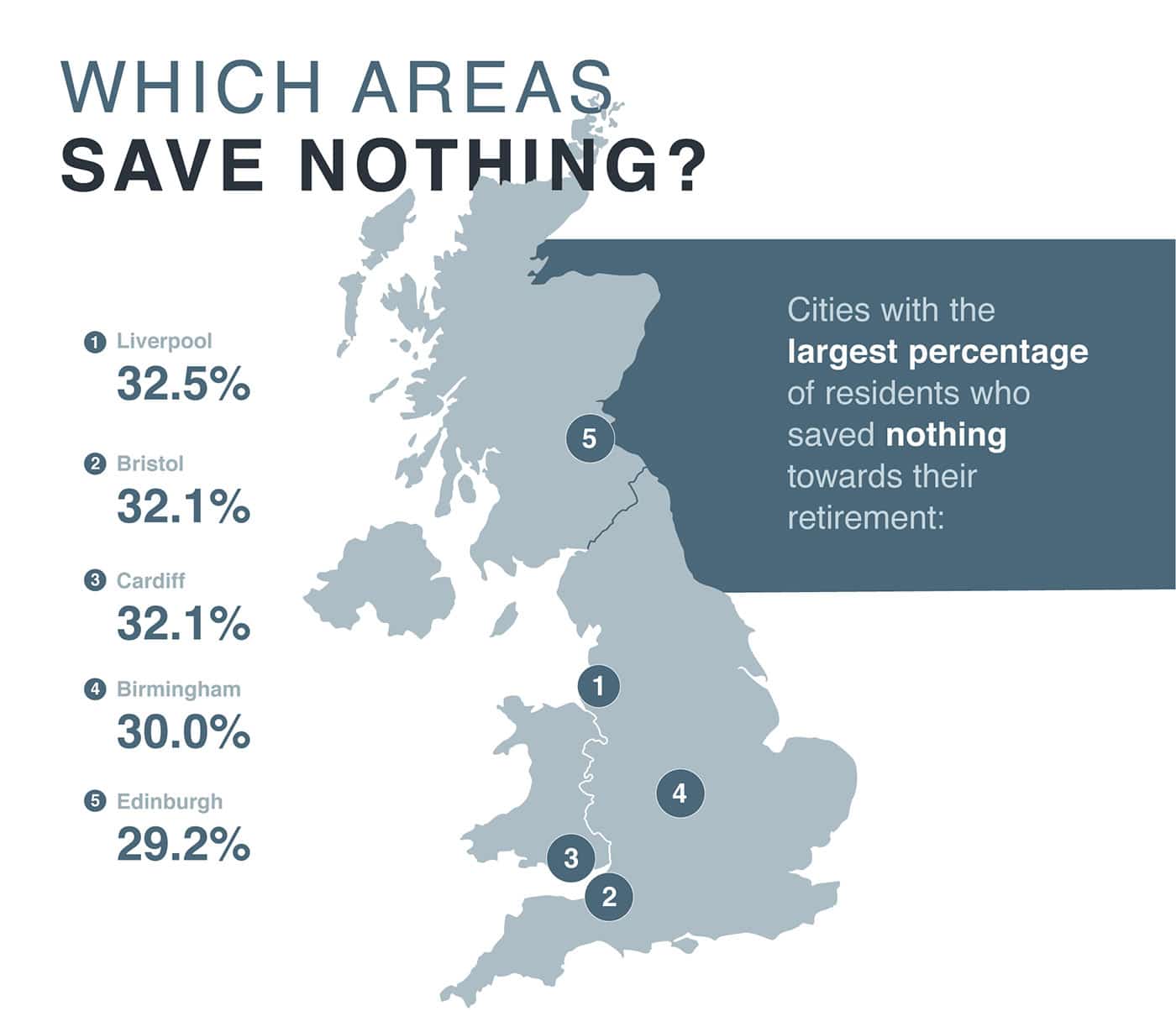

Cities with the largest percentage of residents who saved nothing towards their retirement:

- Liverpool 32.5%

- Bristol 32.1%

- Cardiff 32.1%

- Birmingham 30.0%

- Edinburgh 29.2%

Tips on how to save for your retirement

We have revealed top tips on how to save efficiently for your retirement:

- Create a budget and follow it

The best way to plan a budget in order to save is knowing how much you can spend weekly. Check out our recent post on how to review your finances here

- Pay off your mortgage

Your home contributes significantly to your fixed expenses. By paying off your mortgage you can finally live there ‘rent-free’, this eliminates a large monthly spend.

- Talk to your spouse or significant other about savings

Be open with your partner about your finances, and about how you should both be saving and will spend in retirement. It’s always helpful to chat openly about finances and avoids any awkward discussions later down the line.

- Prioritise your pension

If you concentrate for saving for your pension rather than saving short term this will help yourself long term.

Sources

UK national retirement age – https://www.gov.uk/state-pension-age

UK national workplace pension contribution – https://www.thepensionsregulator.gov.uk/en/employers/managing-a-scheme/contributions-and-funding

UK long-term inflation rate – https://tradingeconomics.com/united-kingdom/inflation-cpi

State pension age predicted to increase to 68 – https://www.gov.uk/government/news/proposed-new-timetable-for-state-pension-age-increases#:~:text=The%20proposals,to%20bring%20this%20timetable%20forward.&text=Since%201948%20the%20State%20Pension,to%20all%20in%20later%20life.

Methodology

To calculate the results, Blacktower financial analysts predicted that a person would need 75% of their starting salary per year, in retirement. The subsequent data is based on:

- The UK national salary of £29,009

- Workplace minimum contribution of 8%

- UK long term inflation rate of 2.5%

- State pension age predicted to increase to 68

The results show the amount needed if you do and do not pay into a workplace pension scheme.

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.