1) January: New Year, Old Problems

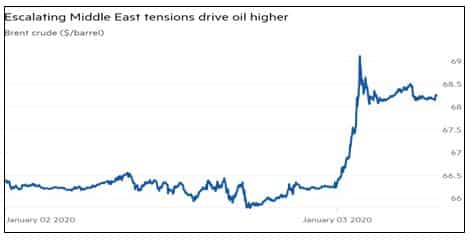

After decades of tension between the US and Iran, the year started with a boiling point. Following heated exchange of accusations and attacks from both sides, this month marked probably the closest these two countries had been from going to war.

Source: Refinitiv

This uncertainty saw oil prices rise sharply initially, only to fall for the remainder of January. This was mainly due to the fact that (1) Iran’s oil production shortfall could easily be offset by Saudi Arabia and remaining OPEC members and (2) worrying news came from China…

2) February: Patient 31

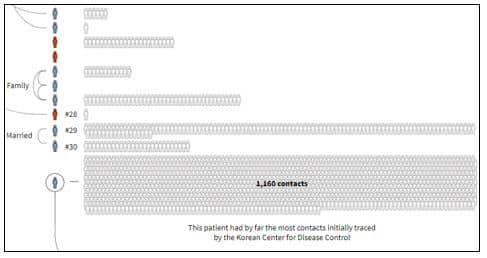

Until the end of January, a yet unnamed virus began to circulate in China, but was largely contained within the country’s borders, which led to some apprehension but not too many reasons for excessive worry. However, this all changed when it became public that South Korea’s 31st confirmed case was responsible for the rapid spread of the virus, after being in contact with more than 1 000 people, including in hospitals and churches.

Source: Reuters

The impact of “Patient 31” on the spread of the virus compared to previous infections.

This event was a game-changer and warned the world for the worrying effects that a seemingly ordinary interaction could have on public health.

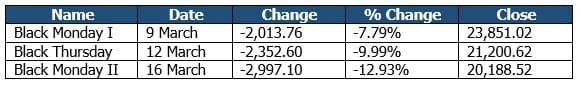

3) March: The Coronavirus Hits

March saw the stock market get hit hard by the uncertainty of Covid-19. This crash was so staggering that, within 1 week, the Dow Jones Industrial Average index faced not one, but three significant crashes:

Tourism stocks were particularly hit hard, but the consequences were so severe that we witnessed systemic effects and a spread across the vast majority of sectors.

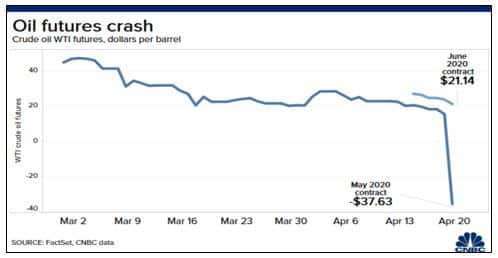

4) April: Negative Oil

In a year full of “once in a lifetime” events, April saw oil prices turn negative for the first time in history. As the world was put on hold, oil demand was rapidly and significantly surpassed by the total supply in the market, which led the commodity futures to an historic mark of -$37 on April 20th, meaning that investors could actually get paid for taking on the physical delivery of a barrel of oil (and all the costs involved with it).

Source: CNBC

5) May and June: Stocks Recover

Contrary to the general consensus, the North American stock markets appeared to display an unexpected “V-Shaped” recovery:

Source: Bloomberg

Driven by a historic (like most things 2020-related) stimulus package by the US Government and a global low interest rates environment, investors turned to equities on search for yields that were simply not shown in other asset classes that could act as “safe-havens” in times of uncertainty.

6) July: Big Tech Leads the Way

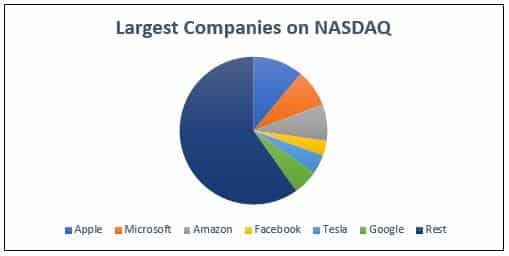

Amid all the uncertainty caused by the pandemic, one thing became much clearer: technology will help us keep moving forward. To understand the increasing impact of “Big Tech” companies (and also Tesla) on the current markets, below is a display of the weight of the 6 major companies on the Nasdaq 100.

Source: Nasdaq.com

Currently, the “Big 5” (and also Tesla) are worth approximately 45% of the whole index.

7) August and September: The Bear Market Ends

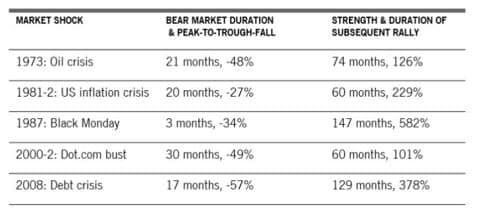

If the Covid crash was an unprecedented one, the same cannot be said about the bear market that followed. Going back as early as the 1920s, the average bear markets that followed, endured for a median 300 days. However, this year, the S&P 500 was able to resume its upward trend after a 33-day bear market, making it the shortest on record.

Source: Bloomberg

9) October: A Rising Star Called Zoom

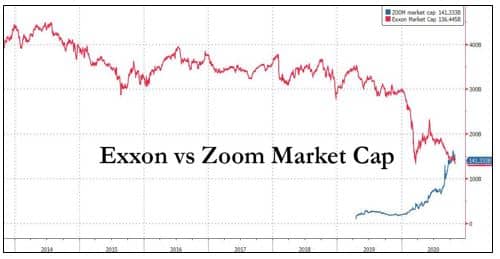

With the world working from home, and families unable to meet in person, video chat apps quickly rose to become one of the fastest rising “niches” in 2020. The rise in users was so significant that by October, Zoom alone was worth more than Exxon Mobil, one of the world’s largest Oil giants.

Source: Zerohedge

By October, Zoom shares had risen 658% Year-Over-Year, with Exxon losing around 55% in value.

11) November: US Elections

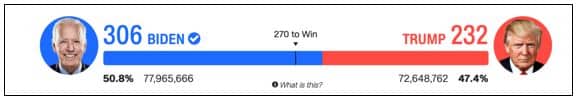

An unprecedented year could not end without an unprecedented US Election. November marked the month of the highest voter turnout in an US Election since 1900, with President elect Joe Biden receiving more than 80 million votes, a record-high in American history.

Source: CNN

12) December: A New Hope

It can be hard to be optimistic after such a dismal year, but I would like to conclude with a hopeful tone.

On December 8th, a UK citizen called Margaret Keenan became the first person in the world to receive the Pfizer Covid-19 vaccine and kickstarted what we hope to be a global and concentrated effort to leave this pandemic behind us. We can only wish and hope for very quick and visible results of these efforts, but it’s definitely hopeful to enter 2021 knowing that, once again, science was able to reach yet another milestone and produce a potential global solution in such an incredible period of time.

There will still be downturns and risks, as we are facing yet again another lockdown, but as history has taught us: this too shall pass.

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.

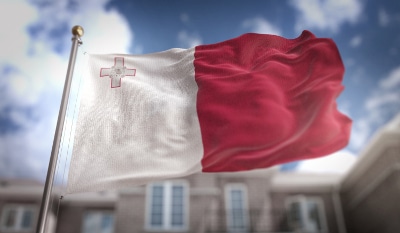

In our “Around the Branches” segment we take a look at some of the concerns affecting our clients and our business in individual locations. This time we are in Malta where the regulatory landscape could be changing for financial services firms operating on the island nation.

In our “Around the Branches” segment we take a look at some of the concerns affecting our clients and our business in individual locations. This time we are in Malta where the regulatory landscape could be changing for financial services firms operating on the island nation. One of the main concerns of parents when they are considering relocation to Spain, is of course the quality of the education available. Alongside questions around the type of employment opportunities available and the overall quality of life, education is one of the key factors in deciding where to eventually settle.

One of the main concerns of parents when they are considering relocation to Spain, is of course the quality of the education available. Alongside questions around the type of employment opportunities available and the overall quality of life, education is one of the key factors in deciding where to eventually settle.