Why Portugal Remains One of the Best Countries for UK and US Expats in 2025

Portugal has long been one of Europe’s most attractive destinations for British and American expats — and for good reason. Its combination of a sunny climate, welcoming culture, and favourable tax structures has made it a top choice for retirees, digital nomads, and internationally mobile professionals alike.

Whether you’re looking to retire by the coast, enjoy a better work-life balance, or restructure your financial affairs more efficiently, Portugal continues to offer a unique blend of lifestyle benefits and wealth advantages that few other European countries can match.

In this comprehensive guide, we’ll explore why Portugal remains one of the best countries for expats from the UK and US in 2025, including residency options, tax advantages, cost of living, lifestyle benefits, and the importance of financial planning when making the move.

A Lifestyle That’s Hard to Beat

Portugal consistently ranks among the world’s best places to live.

- Over 700,000 foreign residents now call Portugal home, with growing communities of British, American, Dutch, and French nationals.

- According to InterNations’ most recent Expat Insider survey, Portugal ranked in the top 5 globally for quality of life, safety, and friendliness.

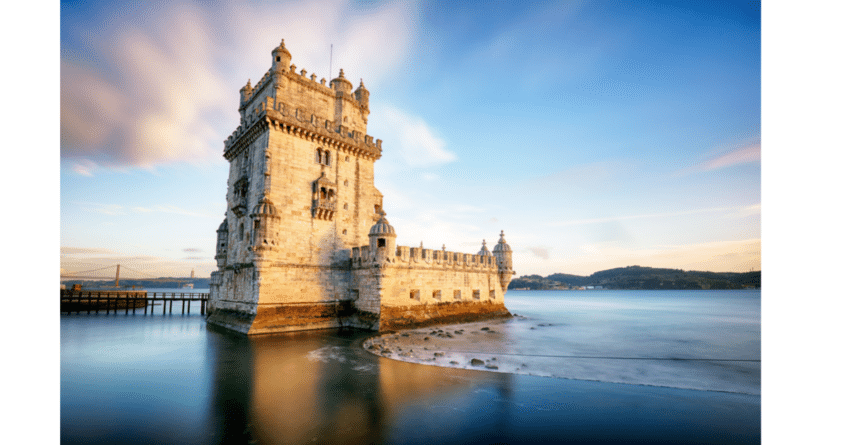

Sunshine, Sea, and Space to Breathe

Portugal offers over 300 days of sunshine per year, some of Europe’s cleanest air, and a relaxed pace of life that contrasts sharply with the fast-paced culture of London or New York.

From the cobbled streets of Lisbon and Porto to the tranquil beaches of the Algarve or the lush landscapes of the Silver Coast, there’s a region to suit every taste. For retirees and digital nomads alike, the combination of safety, outdoor lifestyle, and healthcare standards makes Portugal a natural fit.

English-Friendly and International

English is widely spoken in urban areas and along the Algarve, and Portugal’s expat community is one of the most established and supportive in Europe.

Cultural events, international schools, and co-working hubs have flourished, particularly in Lisbon, Cascais, and Lagos — making integration smooth for both families and professionals.

Residency and Visa Options for UK and US Expats

Since Brexit, UK nationals are treated as non-EU citizens, joining Americans in needing a visa to reside long-term in Portugal. Fortunately, Portugal’s visa system remains among the most flexible and expat-friendly in Europe.

1️⃣ D7 Visa (Passive Income Visa)

One of the most popular options for retirees and financially independent individuals, the D7 visa allows non-EU citizens to live in Portugal based on passive income — such as pensions, rental income, or investments.

Key benefits include:

- Pathway to permanent residency and citizenship after five years.

- Access to Portugal’s healthcare and education systems.

- The ability to include family members under the same application.

In 2025, the D7 remains the preferred route for retirees and semi-retired individuals relocating from the UK or US.

2️⃣ Digital Nomad Visa

Launched in 2022, this visa targets remote workers earning income from abroad.

- Applicants must earn at least €3,280 per month (4x Portuguese minimum wage).

- It’s ideal for professionals with online businesses or remote employment.

3️⃣ Golden Visa (Investment Residency)

Portugal’s Golden Visa remains open through indirect routes, such as investment in qualifying funds, cultural projects, or scientific research.

While property-based routes were phased out in 2023, fund investments from €500,000 still qualify.

The Golden Visa offers a path to EU citizenship after five years with minimal stay requirements — appealing to global investors seeking flexibility and European mobility.

Tax Efficiency: One of Portugal’s Biggest Draws

For UK and US expats, Portugal’s tax landscape is often a game-changer — particularly when combined with careful financial planning.

Non-Habitual Residency (NHR) and Its Successor Scheme

Until 2024, Portugal’s Non-Habitual Residency (NHR) regime was a major incentive for foreign residents, offering a 10-year period of reduced or even zero taxation on certain foreign income.

While the NHR scheme has been phased out for new applicants, the Portuguese government has introduced a “Tax Incentive for Scientific Research and Innovation” regime in 2024. This replacement still provides significant tax reductions for professionals working in specific fields — particularly those in education, technology, and R&D.

For retirees, alternative tax planning opportunities remain available through:

- Double Tax Treaties (with both the UK and US)

- Efficient pension structuring to avoid double taxation

- EU-compliant investment wrappers that help reduce ongoing tax liabilities

A professional adviser can help you navigate which route offers the greatest benefit depending on your source of income and long-term goals.

Tax Treaties and Cross-Border Advantages

UK–Portugal Double Taxation Treaty

The treaty ensures that income is not taxed twice. For UK retirees:

- UK state pensions are generally taxable only in Portugal (not the UK).

- Government service pensions (e.g. NHS, military, civil service) remain taxable in the UK, but exempt in Portugal.

- Dividends and capital gains can often be structured to avoid double taxation entirely.

US–Portugal Double Taxation Treaty

American expats benefit from an equally robust treaty between the two nations.

Although the US taxes its citizens worldwide, the treaty and Foreign Tax Credit system allow you to offset Portuguese tax paid against your US liability.

Specialist planning is essential to ensure investments, pensions, and trusts are structured correctly to avoid overpayment.

Cost of Living: Affordable European Luxury

While Portugal’s prices have risen in recent years, the cost of living remains significantly lower than in the UK or the US — especially in comparison with London, New York, or San Francisco.

| Category | Approximate Monthly Cost (Lisbon) | Approximate Monthly Cost (Algarve) |

|---|---|---|

| Rent (1-bed apartment) | €1,200 – €1,800 | €900 – €1,400 |

| Utilities (electricity, water, internet) | €150 – €200 | €130 – €180 |

| Groceries | €250 – €350 | €250 – €300 |

| Private Health Insurance | €50 – €120 | €50 – €100 |

| Dining Out | €15 – €25 per meal | €12 – €20 per meal |

Even in premium regions like Cascais or Quinta do Lago, expats report that quality of life far exceeds what the same income would deliver in most major UK or US cities.

Healthcare and Education

Portugal’s healthcare system ranks among the best in Europe, with both public and private options.

- The Serviço Nacional de Saúde (SNS) provides affordable care once registered as a resident.

- Many expats opt for private health insurance, which offers faster access to English-speaking specialists.

For families, international schools are available across Lisbon, Porto, and the Algarve, offering British and American curricula — making Portugal attractive to both retirees and younger professionals.

Property and Lifestyle Investments

Buying in Portugal

Property remains a key attraction for expats, with well-developed markets in Lisbon, Porto, and the Algarve.

While property prices have risen, Portugal still offers better value per square metre than comparable European destinations such as Spain or France.

IMT (Property Transfer Tax) and IMI (Municipal Property Tax) should be factored into purchase costs. Proposed legislation to increase IMT rates for non-residents has made headlines in 2025, but details remain under consultation.

Despite these discussions, long-term residents and retirees remain a cornerstone of Portugal’s economy, and policymakers have shown willingness to balance affordability for locals with the continued contribution of the expat community.

Cultural and Social Benefits

Portugal’s charm extends beyond the financial and practical. It’s a country where people genuinely value quality of life — where long lunches, outdoor living, and community spirit define daily life.

- The Portuguese are notoriously friendly and patient with foreigners.

- Crime rates are among the lowest in Europe.

- Cultural and recreational life is rich — from Fado music and world-class golf to surfing, sailing, and fine dining.

For many, Portugal offers a renewed sense of balance — a slower, sunnier, and more fulfilling way of life.

Challenges to Be Aware Of

Every relocation comes with considerations:

- Bureaucracy: While improving, Portugal’s administrative processes can be slow and complex.

- Language: English is widely spoken, but learning basic Portuguese goes a long way.

- Tax Complexity: Despite incentives, cross-border taxation — especially for dual citizens or those with multiple pensions — requires careful management.

These are not deal-breakers, but highlight why expert financial and tax advice is critical before and after your move.

Financial Planning for a Successful Move

Moving abroad is about more than just changing your address — it’s about restructuring your financial life across multiple jurisdictions.

At Blacktower Financial Management, we’ve been helping UK and US expatriates protect and grow their wealth since 1986. Our advisers understand the nuances of living between two tax systems and can help ensure that every element of your financial plan is optimised.

Our services include:

- Cross-border tax and pension planning

- Wealth and investment management

- Retirement income strategies

- Estate and inheritance planning

- Residency and relocation support

Why Work With a Cross-Border Adviser?

For expats, the financial landscape is far more complex than for those living solely in one country.

The wrong structure can lead to:

- Double taxation

- Inheritance complications

- Unnecessary investment restrictions

- Loss of UK pension or tax benefits

An adviser experienced in both UK/US and EU regulations can help you avoid these pitfalls and build a strategy tailored to your residency, domicile, and long-term financial goals.

Final Thoughts

Portugal continues to embody everything expats dream of: a high standard of living, cultural warmth, and a tax environment that rewards thoughtful planning. Whether you’re retiring, working remotely, or diversifying your lifestyle, the country remains one of the most desirable and financially intelligent choices for UK and US nationals alike.

By combining professional financial advice with smart, compliant planning, you can make the most of everything Portugal has to offer — while ensuring your wealth works harder, wherever you call home.

💡 Speak to a Blacktower Adviser Today

Since 1986, Blacktower Financial Management has been helping expatriates worldwide secure their financial futures.

If you’re considering a move to Portugal — or already living here — our experienced advisers can help you optimise your pensions, investments, and tax position for life abroad.