In fact, a recent piece of research found that nearly half of all new retirees (45.9%) actually have greater outgoings in the two years immediately following retirement than they did before stopping work. Even six years later 33.4% are still spending more than they were during their working years. Interestingly, this is a trend that is not only confined to individuals of high net worth; it seems that no matter how much money you have, your chances of increased retirement spending are roughly the same.

As those expats with a QROPS in France and elsewhere can probably attest, it may be that QROPS pensions are one of the reasons that so many retirees feel comfortable enough to increase spending once they have given up work; flexible pensions give people freedom and allow for the kind of outlays – whether second homes, campervans or holidays – that are synonymous with a long and enjoyable retirement.

In fact, around one third of people between 55 and 75 say that they hope to be able to withdraw between £2,000 and £5,000 so that they can take an extended trip away, while 20% of pensioners say that they would like to withdraw from their pension so that they can make improvements or adaptations to the home.

Perhaps the biggest indicator of the shift in attitudes to retirement is to be found in the fact that many plan to access their pensions to start a business or move into a consultancy role. Finally, with younger generations struggling to buy a home, many pension aged people, including expats in France, are using their QROPS to help their children and grandchildren buy homes in an otherwise inaccessible property market.

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.

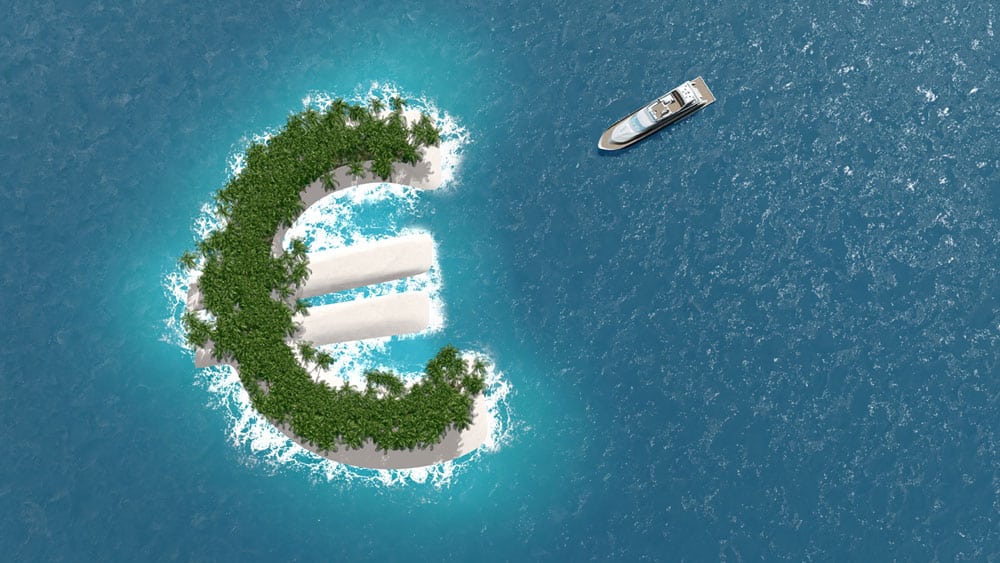

were digesting news of a major leak of confidential and reportedly revealing documents from a Panamanian law firm. Some are calling it the biggest leak of confidential information ever to hit the global financial services industry.

were digesting news of a major leak of confidential and reportedly revealing documents from a Panamanian law firm. Some are calling it the biggest leak of confidential information ever to hit the global financial services industry.