The effect of this is that expats who seek advice abroad regarding their pension must also seek advice from a UK professional authorised to do so.

Now the Association of British Insurers, together with a number of wealth management professionals, has called for the government to abolish the advice rule and instead replace it with a guidance session, saying that any such move would also reduce the fees burden on consumers.

The survey questioned nearly 300 advisors from across Europe, Asia, the Middle East and Africa and discovered significant resistance to the new rules, which require consumers to pay an additional fee to a UK adviser, while also raising concerns that having two advisors could muddy any potential liability issues.

“A surprisingly high number of overseas advisers [69%] have already successfully linked up with UK adviser firms but the number of advisers who have faced challenges is alarming,” commented a spokesperson with Old Mutual.

“It is imperative that clients are not detrimentally impacted, so we would welcome a review by the Department for Work and Pensions.”

If you are unsure about QROPS rules, contact Blacktower for bespoke advice regarding your personal situation.

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.

If you’ve recently become an expat, what’s your favourite aspect of your new surroundings so far?

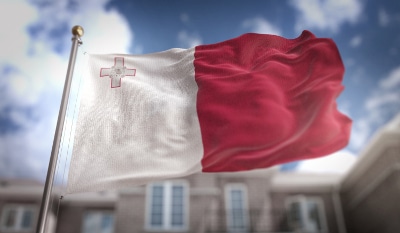

If you’ve recently become an expat, what’s your favourite aspect of your new surroundings so far? In our “Around the Branches” segment we take a look at some of the concerns affecting our clients and our business in individual locations. This time we are in Malta where the regulatory landscape could be changing for financial services firms operating on the island nation.

In our “Around the Branches” segment we take a look at some of the concerns affecting our clients and our business in individual locations. This time we are in Malta where the regulatory landscape could be changing for financial services firms operating on the island nation.