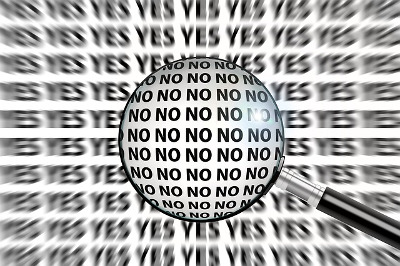

It transpired that no matter what type of investment I requested (Income, growth, 5 years, 7 year, 9 years) I was offered the same provider (whose company name sounded good but I know is not).

All of the investments were offering me guaranteed capital with high rates of returns, which are not possible in my opinion. They all offered NO access during the term and I wouldn’t be 100% sure the company would still be around at the end of the term.

I put my email details and phone number to request personal information – I now find myself getting several calls per week and at least one email a day from this company

What I would always urge anyone to do is always get a second opinion on anything that is advertised especially through social media. When I asked the friend who had supposedly ‘liked’ the page about this they had never even heard of the comparison website.

What are available for Ex-Pats living in Spain are the Spanish Compliant Bonds that can offer security as well as a very good rate of return and can cater for all risk profiles from the Cautious Investor to the more speculative risk taker.

These can be very tax efficient and offer an excellent vehicle for clients wanting to take regular income or if you just want to let your investments grow over time.

by Keith Littlewood, International Financial Adviser in the Costa Blanca

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.

Expat retirement transfers have the potential to play a critical, and beneficial, part of an expat’s financial planning. However, this is only if the process is undertaken in a considered fashion with reliable, regulated and trustworthy advice that investigates all of the options, including the possibility of a QROPS or SIPPs transfer.

Expat retirement transfers have the potential to play a critical, and beneficial, part of an expat’s financial planning. However, this is only if the process is undertaken in a considered fashion with reliable, regulated and trustworthy advice that investigates all of the options, including the possibility of a QROPS or SIPPs transfer. Relocating to a new place can be an exciting time. Experiencing different environments is usually a good thing, and moving abroad can open up many opportunities, such as the chance to learn a new language and experience a different culture first hand. Whether you’ve relocated in retirement, because of work, or to be with a partner, the expat life can certainly be a fascinating one.

Relocating to a new place can be an exciting time. Experiencing different environments is usually a good thing, and moving abroad can open up many opportunities, such as the chance to learn a new language and experience a different culture first hand. Whether you’ve relocated in retirement, because of work, or to be with a partner, the expat life can certainly be a fascinating one.