Despite August’s interest rate rise to 0.75 per cent, it was not necessarily good news for savers. Nationwide was the first large player to announce its new rates and decided not to pass on the 0.25% rise in full to savers in the first sign that big financial institutions will use the base rate to increase profit margins. The building society said that while its tracker mortgage customers will see a 0.25% rise in their payments, many of its savers will see only a 0.1% increase in rates. Other banks including RBS and Natwest followed suit. In summary – bad for borrowers and bad for savers.

After 10 years of zero or near zero interest rates, savers can rightly feel aggrieved that when rates do finally rise – not the entire amount is being passed on by the banks. Whilst having a sensible amount held on deposit is essential, looking at alternative savings and investment schemes is advisable to generate a real return to at least move in line with inflation. Anyone who has left their savings in cash for the last 10 years will have seen a likely deterioration in value due to a combination of next to no return and the impact of inflation over the same period. To emphasise this point, the impact of inflation over the last 10 years means that £10,000 held in a bank account in 2008 would have needed to grow to over £13,000 by now to combat the effects of inflation. It is unlikely that your bank interest over the 10 years has amounted to over 30% meaning that the real value of your capital has been eroded.

At Blacktower we offer a wide range of investment schemes tailored to suit your specific needs as we are aware that everyone has unique requirements. In order to avail yourself of this service, one of our qualified advisers can be at hand to discuss your options with you and to help you make the right decisions on what to do with your hard-earned savings.

This communication is for informational purposes only and is not intended to constitute, and should not be construed as, investment advice, investment recommendations or investment research. You should seek advice from a professional adviser before embarking on any financial planning activity. Whilst every effort has been made to ensure the information contained in this communication is correct, we are not responsible for any errors or omissions.

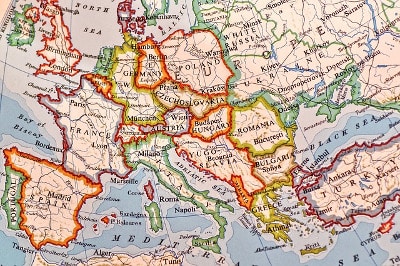

Last year the Association of British Insurers (ABI) provoked something of a panic among British expats in Europe. Those who in some way rely on insurance products, such as annuities and life insurance, for the payment of income and expat pensions were understandably alarmed when Huw Evans of the ABI said that a no-deal Brexit could leave insurance contracts in legal limbo because of a risk that payments could not be fulfilled for contracts written pre-brexit. (

Last year the Association of British Insurers (ABI) provoked something of a panic among British expats in Europe. Those who in some way rely on insurance products, such as annuities and life insurance, for the payment of income and expat pensions were understandably alarmed when Huw Evans of the ABI said that a no-deal Brexit could leave insurance contracts in legal limbo because of a risk that payments could not be fulfilled for contracts written pre-brexit. ( How / why did you get into your line of work in the financial services sector?

How / why did you get into your line of work in the financial services sector?